- News

- Business News

- India Business News

- E-pay flavour but cash is king for offline buys

Trending

E-pay flavour but cash is king for offline buys

MUMBAI: Digital payments may have made inroads into every nook and corner of the country but cash is still the king when it comes to offline purchases.

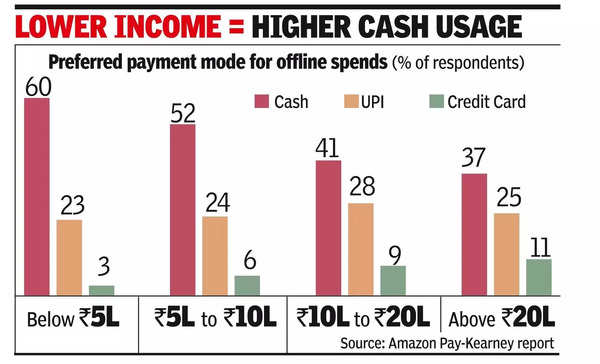

About 60% of the 'aspiring' class (annual income up to Rs 5 lakh) and 52% of the middle class (Rs 5 lakh to Rs 10 lakh) use cash to make offline transactions, finds a survey. This compares with about 37% and 41% of affluent and upper middle class income segments respectively paying cash for offline purchases, says the report by Amazon Pay and management consulting firm Kearney.

"For offline purchases, the preference of digital modes of payment increases with higher income levels," analysts said in the report. Beyond UPI, which has become ubiquitous, the well-heeled also use credit cards and digital wallets. In fact, as transaction size increases, a higher percentage of the consumers in the upper income segments prefer credit cards.

In all, affluent consumers lead the digital payments space using online modes for 80% of transactions. The aspiring segment, though lagging, is fast catching up. The segment uses digital payments for about 67% of the transactions currently.

With smaller cities still under-penetrated in terms of usage of payment modes like credit card-accounting for only 5-6% of transactions in these regions and BNPL, there is potential for higher digital adoption in these towns.

Analysts said that the next wave of digital payments growth is expected to come from small towns and cities. Consumers in cities like Bhopal, Jaipur, Indore and Lucknow are open to experimenting with new methods - these cities demonstrate a digital payment adoption comparable to their large metro counterparts despite their relatively lower retail potential. "With digital transactions penetrating even street vendors and smaller towns, we are at an inflection point," said Vikas Bansal, CEO at Amazon Pay India.

About 60% of the 'aspiring' class (annual income up to Rs 5 lakh) and 52% of the middle class (Rs 5 lakh to Rs 10 lakh) use cash to make offline transactions, finds a survey. This compares with about 37% and 41% of affluent and upper middle class income segments respectively paying cash for offline purchases, says the report by Amazon Pay and management consulting firm Kearney.

"For offline purchases, the preference of digital modes of payment increases with higher income levels," analysts said in the report. Beyond UPI, which has become ubiquitous, the well-heeled also use credit cards and digital wallets. In fact, as transaction size increases, a higher percentage of the consumers in the upper income segments prefer credit cards.

The survey has studied responses of more than 6,000 consumers and 1,000 merchants across 120 cities. Buyers of high value categories such as electronics show more inclination towards using credit cards and buy now pay later (BNPL) options to make such purchases both offline and online. "....many credit cards come with cashbacks, rewards and loyalty points, which incentivise consumers to use them for higher value transactions....the affluent segment leads the adoption of

BNPL with about half of respondents indicating that they use this mode of payment, closely followed by the upper middle class," analysts at Kearney said. In contrast, about 18% of respondents in the aspiring segment are unaware of BNPL while 36% who are aware are not very keen on using it.

In all, affluent consumers lead the digital payments space using online modes for 80% of transactions. The aspiring segment, though lagging, is fast catching up. The segment uses digital payments for about 67% of the transactions currently.

With smaller cities still under-penetrated in terms of usage of payment modes like credit card-accounting for only 5-6% of transactions in these regions and BNPL, there is potential for higher digital adoption in these towns.

Analysts said that the next wave of digital payments growth is expected to come from small towns and cities. Consumers in cities like Bhopal, Jaipur, Indore and Lucknow are open to experimenting with new methods - these cities demonstrate a digital payment adoption comparable to their large metro counterparts despite their relatively lower retail potential. "With digital transactions penetrating even street vendors and smaller towns, we are at an inflection point," said Vikas Bansal, CEO at Amazon Pay India.

End of Article

FOLLOW US ON SOCIAL MEDIA