Report Highlights. Student loan debt statistics among racial and ethnic groups reflect dramatic differences in financial health, habits, and resource availability from one community to the next.

- Black and African American college graduates owe an average of $25,000 more in student loan debt than white college graduates.

- Four years after graduation, black students owe an average of 188% more than white students borrowed.

- Black and African American student borrowers are the most likely to struggle financially due to student loan debt making monthly payments of $260.

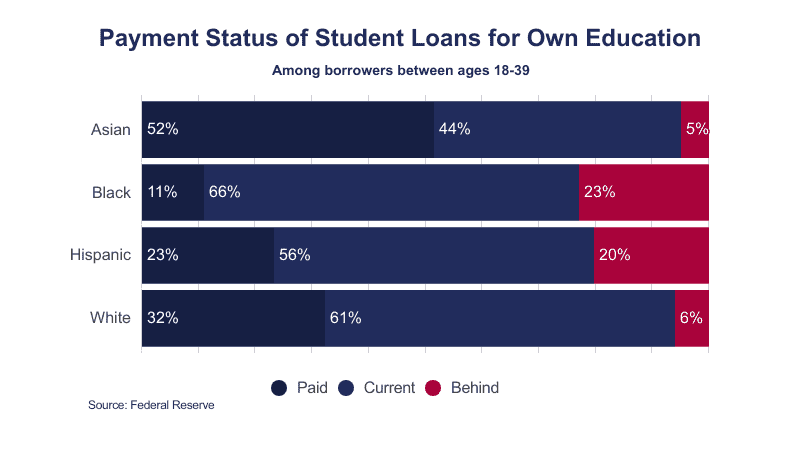

- Asian college graduates are the fastest to repay their loan debt and the most likely to earn a higher salary to help pay for student loan debt.

Related reports include Student Loan Debt Statistics | Student Debt by Age | Student Debt by Sex & Gender | Economic Effects of Student Loan Debt | Student Loan Refinancing

Scientists, economists, and sociologists agree that racial and ethnic variations in student loan debt and repayment are the result of socioeconomic factors, rather than physical or inborn characteristics. Charting trends in student debt across racial and/or ethnic lines helps define these socioeconomic factors. This information influences public policy, as well as financial and academic strategies.

Student Loan Debt by Race and Ethnicity

The fact that borrowers of certain races and ethnicities face exceptional obstacles in their quest for advanced education is universally accepted among academic financial specialists.

- Black and African American bachelor’s degree holders have an average of $53,000 in student loan debt.

- 45% of the gap between Black students and White students is from student loans for graduate school.

- 40% of Black graduates have student loan debt from graduate school, while 22% of White college graduates have graduate school debt.

- Over 50% of Black student borrowers report their net worth is less than they owe in student loan debt.

- At 52%, Asian and White student borrowers are the most likely to have a net worth that exceeds their student loan debt.

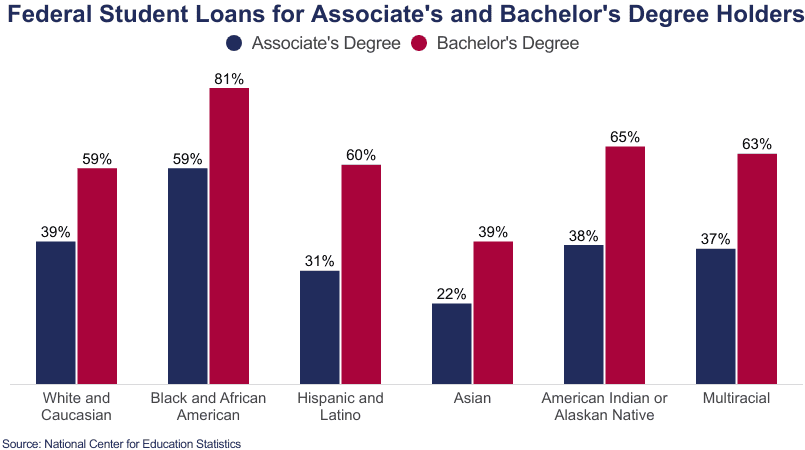

- 59% of Asian graduates left college with educational loan debt.

- 67% of Hispanic and Latino graduates left college with educational debt.

- 70% of White and Caucasian graduates left college with student loan debt.

- White college graduates have over 7 times the amount of wealth than Black college graduates.

Student Loan Debt Payments by Race

Student loan repayment plans typically establish a regular monthly payment. It may be based on a percentage of their income and/or the size of their remaining debt. Lower monthly payments mean a higher ultimate cost due to interest rates.

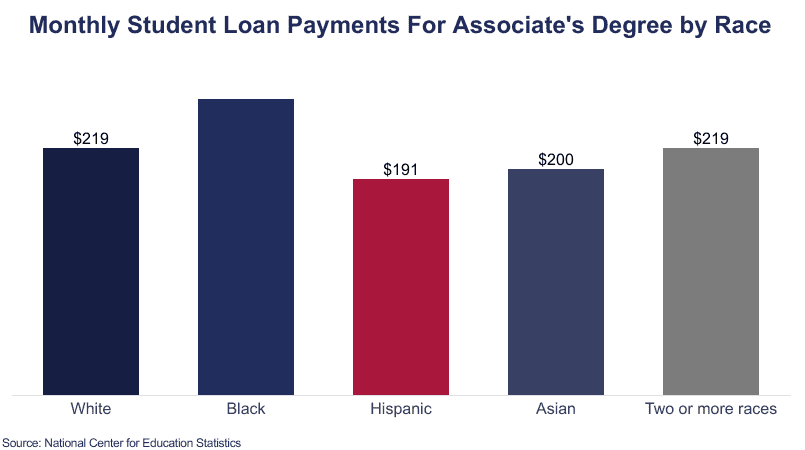

- Black student borrowers owe the highest monthly payments.

- Black student borrowers with an associate’s degree are the most likely to have monthly payments of $260.

- Black student borrowers with a bachelor’s degree are the most likely to have monthly payments of $390.

Student Loan Debt Impact by Race

Student loan debt may have a significant effect on an indebted borrower’s financial decisions. Many student borrowers report that they’ve delayed life goals and milestones due to debt. Stress related to educational debt may also hinder personal timelines.

- Hispanic and Latino borrowers were the most likely to delay getting married and having children due to student loan debt.

- 33% of Hispanic student borrowers say they put off getting married due to their student loan debt.

- 37% of Hispanic borrowers delayed having children due to debt.

- At 46%, black student borrowers were the most likely to put off buying a home.

- At 43%, black indebted student borrowers are also the most likely to report having to work more than they would prefer.

- In 2012, Black bachelor’s degree holders were the most likely among their indebted peers to describe their educational debt-related stress as “very high.”

- Multiracial degree holders were the most likely to report “high” stress levels.

- Multiracial and Black bachelor’s degree holders were also the least likely to call their stress levels “very low.”

- 58% of Black borrowers do not believe student loans have advanced racial equality.

- 66% of Black borrowers report they regret having taken out student loans to fund their education.

Student Loans by Race and Ethnicity

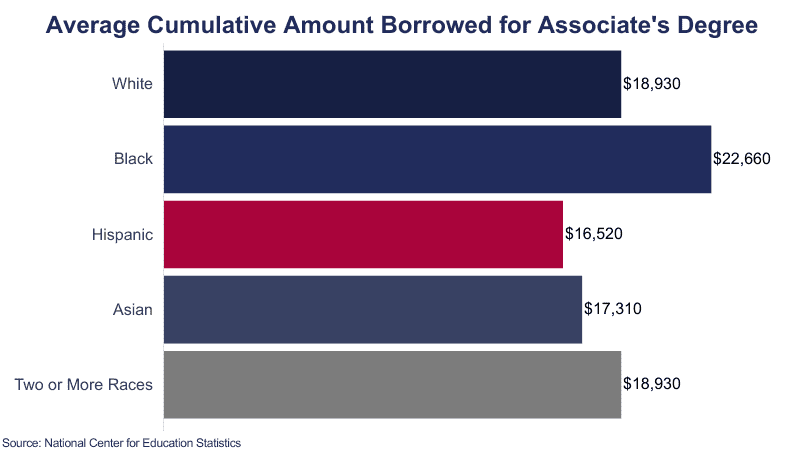

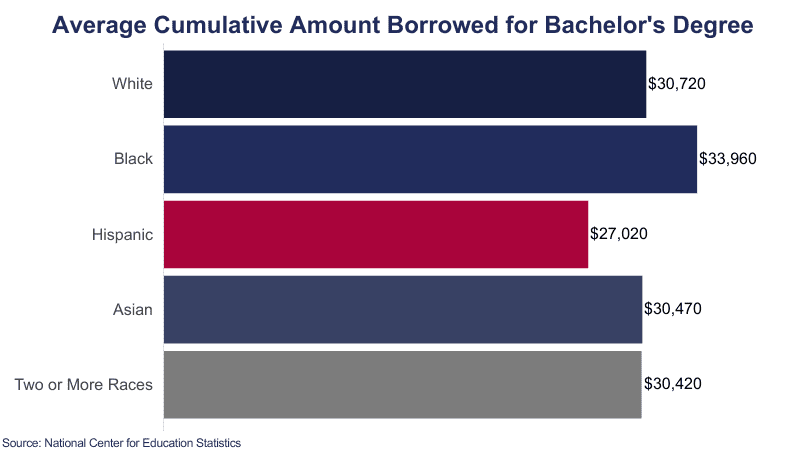

Logically, the initial amount borrowed has a tremendous impact on outstanding student loan debt as well as the amount a borrower ultimately pays. Most undergraduate students borrow less than $15,000 annually.

- 47% of white undergraduate students use student loans to pay for school.

- 54% of student loan money goes to white students.

- 66% of black students use student loans.

- 15% of loan money goes to black students.

- Asian students use 8% of student loan money.

- 0.5% of loans go to Pacific Islanders

- Black students are the most likely to receive Federal loans.

- Asian students are least likely to receive Federal loans.

- Multiracial students are most likely to receive nonfederal loans.

- Asians are the least likely to receive nonfederal loans.

- During the 2019-2020 academic year, Mutiracial students received the largest average loan at $14,930.

- That same year, Asian students received the second-largest average loan at $14,210.

- American Indian/Alaskan Native students received the lowest average loan amount at $10,590.

- 57% of Black borrowers reported having at least $25,000 of debt from their education.

Student Loan Debt Forgiveness & Race

Most research regarding student loan debt forgiveness and race focuses on the impact on Black borrowers. While the elimination of loan payments allows households to reallocate those funds to investments, lawmakers disagree on how student loan debt forgiveness might impact racial wealth gaps in the long run.

- Black borrowers were more likely to indicate they would use loan forgiveness to pay off their debt.

- Student loan debt forgiveness would immediately increase the wealth of Black Americans by up to 40%.

- Black college attendees have a net worth that is $8,500 less than their White peers.

- White bachelor’s degree holders make 30% more in median annual income than their black counterparts.

- White households have a homeownership rate of 70% while 47% of Black households own their home

- 60% of still-indebted black student loan borrowers do not have a savings account.

- Among Black student borrowers on income-driven repayment plans, 71% do not have a savings account.

Sources

- The Education Trust, Jim Crow Debt, How Black Borrowers Experience Student Loans

- National Center for Education Statistics (NCES), Digest of Education Statistics

- NCES, Debt After College, Employment, Enrollment, and Student-Reported Stress and Outcomes

- U.S. Department of Education, Fact Sheet, Black College Graduates and the Student Debt Gap

- New York Department of Consumer Affairs, Unequal Burden, Black Borrowers and the Student Loan Debt Crisis

- Roosevelt Institute, How Canceling Student Debt Would Bolster the Economic Recovery and Reduce the Racial Wealth Gap

- The Brookings Institution, Student Loans, The Racial Wealth Divide, And Why We Need Full Student Debt Cancellation

- PBS, Student Loan Debt Has A Lasting Effect On Black Borrowers

- Federal Reserve Board of Governors, Economic Well-Being of U.S. Households

- NCES, Annual Reports and Information, Annual Earnings By Educational Attainment

- NCES, Baccalaureate and Beyond (B&B: 16/20), First Look at the 2020 Employment and Educational Experiences of 2015–16 College Graduates