Report Highlights. The average student borrower takes 20 years to pay off their student loan debt.

- 43% of borrowers are on the standard 10 years or less plan with fixed payments.

- Some professional graduates take over 45 years to repay student loans.

- 21% of borrowers see their total student loan debt balance increase in the first 5 years of their loan.

- The average medical school graduate’s salary is not sufficient to make their student loan payments.

Related reports include Student Loan Debt Statistics | Average Student Loan Debt | Student Loan Debt by State | Average Student Loan Interest Rate | Student Loan Refinancing

| Monthly Payment |

Ultimate Cost |

Time to Zero Debt |

|---|---|---|

|

516‡ |

$46,239 |

7 yrs, 6 mos |

|

$460 |

$47,622 |

8 yrs, 8 mos |

|

$404◊ |

$49,569 |

10 yrs, 3 mos |

†The average debt is based on the federal student loan debt portfolio and does not necessarily reflect the true average debt for 2023 undergraduates.

‡ 10% of the typical starting gross income value for recent graduates (Bachelor’s).

◊10% of the typical starting net income value for recent graduates (Bachelor’s).

Average Student Loan Repayment Timelines

The amount of time it takes for an individual to repay their student loan debt depends on the initial amount borrowed, the loan’s interest rate, and repayment habits, among other factors.

- 10 years is the ideal timeline for paying off student loan debt according to financial experts and the U.S. Department of Education (ED).

- 43% of borrowers are on the standard 10 year or less plan with fixed payments.

- 8% of borrowers are on a plan to pay off their federal loans over 10 years or less with graduated payments.

- 5% of borrowers are on a plan to pay their federal loans over more than 10 years with fixed payments and 2% are on a plan to pay over more than 10 years with graduated payments.

- 25% of borrowers are on the SAVE payment plan, which allows payments based on a percentage of the borrower’s income.

- 15% of borrowers are on an income-based plan that allows for loan forgiveness after 20 or 25 years.

- In practice, it takes borrowers closer to 20 years to pay off their student loans.

- 21.1 years was the average length of repayment in a 2013 study of 61,000 respondents.*

- 45% of student loan borrowers decrease their balance in the first five years of repayment.

- 21% of student loan borrowers increase their balance in that same period.

- The average medical school graduate’s salary is not sufficient to make their student loan payments.

- Most students owe between $20,000 and $40,000 in student loan debt.

- 52.7% of indebted borrowers owe $20,000 or less in student loans.

- 32.1% of indebted student borrowers owe $10,000 or less in federal student loans.

- 15.0% of borrowers owe less than $5,000.

- 20.6% of borrowers owe between $10,000 and $20,000 in student loans.

- 18.1% owe $40,000 to $100,000.

- 7.5% owe $100,000 or more.

- 2.2% owe in excess of $200,000.

*More recent reports claim shorter timelines (~18.5 years), but this comes from a poll of 2,200 borrowers between the ages of 26 to 45.

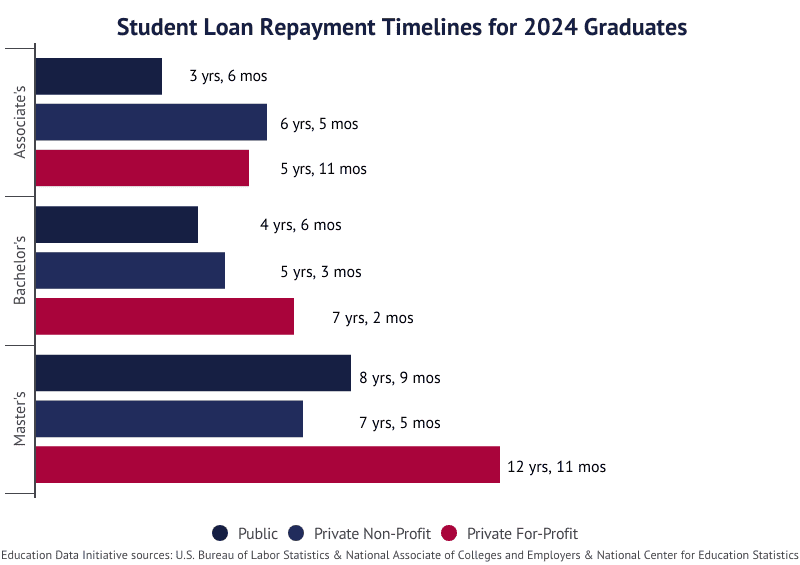

Class of 2024 Student Loan Repayment Timelines

Student loan interest rates for 2025-25 are the highest in a decade. At 6.53%, current students may have a harder time paying off their student loan debts within the recommended 10-year timeline.

- 6.53% is the 2024-2025 interest rate for Direct Subsidized and Unsubsidized federal student loans to undergraduate borrowers.

- 5.50% is the 2023-2024 interest rate for Direct Subsidized and Unsubsidized federal student loans to undergraduate borrowers.

- 10% of income should go toward paying off debts according to federal guidelines.

- 36% of income is the maximum amount that should go toward paying off debt.

- $26,701 is the low-end average starting salary for a new graduate with a bachelor’s degree.

- $72,731 is the high-end starting salary.

- $61,870 is the median salary for new graduates with bachelor’s degrees.

- $77,600 is the average annual salary for a college graduate with a bachelor’s degree.

- 3 to 7+ years is the projected student loan debt repayment period for bachelor’s degree holders who graduate in 2024.

| Monthly Payment |

Average Debt |

Ultimate Cost |

Time to Zero Debt |

|---|---|---|---|

| $223 | $23,390 | $31,958 | 12 yrs, 0 mos |

| $223 | $26,720 | $38,851 | 14 yrs, 7 mos |

| $223 | $34,740 | $61,046 | 22 yrs, 10 mos |

| $491 | $23,390 | $26,449 | 4 yrs, 6 mos |

| $491 | $26,720 | $30,807 | 5 yrs, 3 mos |

| $491 | $34,740 | $42,089 | 7 yrs, 2 mos |

| $647 | $23,390 | $25,631 | 3 yrs, 4 mos |

| $647 | $26,720 | $29,689 | 3 yrs, 10 mos |

| $647 | $34,740 | $40,200 | 5 yrs, 5 mos |

Associate’s Degree Debt Repayment

Student borrowers with associate’s degrees are significantly less likely to take on student loan debt if they attend public institutions. Private school attendees are actually more likely than their bachelor’s degree-seeking peers to use student loans to pay for school.

- Just 31% of Associate’s degree students who graduated from public institutions use student loans to pay for school.

- 77% of attendees of private, nonprofit schools take on student loan debt.

- 91% of attendees of private, for-profit schools take on student loan debt.

- $55,016 is the average annual salary for an associate’s degree holder.

- $47,900 is the median salary for new graduates with associate’s degrees.

- 3 to 6 years is the projected student loan debt repayment period for associate’s degree holders who graduate in 2024.

| Average Debt | Ultimate Cost | Time to Zero Debt |

|---|---|---|

|

$14,900 |

$16,380 |

3 yrs, 6 mos |

|

$25,800 |

$30,669 |

6 yrs, 5 mos |

|

$24,100 |

$28,281 |

5 yrs, 11 mos |

Graduate Student Loan Debt Repayment Timelines

Graduate and professional students, on average, borrow more for school than undergraduate students. Their income rates tend to be higher, as well.

- 7.05% is the 2023-2024 interest rate for Direct Unsubsidized federal student loans to graduate or professional borrowers.

- 8.05% is the interest rate for Direct PLUS loans, which go to graduate or professional borrowers as well as parents of undergraduates borrowing on their behalf.

- $58,640 is the average student debt for a borrower who graduated from a public institution with a Master’s degree.

- $76,360 is the average debt for master’s degree holders who attended a private, for-profit institution.

- $72,560 to $178,800 is the range of average debt for doctoral degree holders.

- $142,930 is the average debt for professional degree holders who attended private, nonprofit institutions.

- $90,324 is the average salary for a master’s degree holder.

- $109,668 and $208,310 are the average respective salaries for people with professional and doctoral degrees.

| APR % | Current Debt |

Ultimate Cost |

Time to Zero Debt |

|---|---|---|---|

|

7.05% |

$58,640 |

$78,619 |

8 yrs, 9 mos |

|

7.05% |

$52,040 |

$66,962 |

7 yrs, 5 mos |

|

7.05% |

$76,360 |

$116,434 |

12 yrs, 11 mos |

|

8.05% |

$58,640 |

$83,230 |

9 yrs, 3 mos |

|

8.05% |

$52,040 |

$70,154 |

7 yrs, 10 mos |

|

8.05% |

$76,360 |

$128,426 |

14 yrs, 3 mos |

| APR % | Current Debt |

Ultimate Cost |

Time to Zero Debt |

|---|---|---|---|

|

7.05% |

$160,530 |

NA** |

NA |

|

7.05% |

$212,430 |

NA** |

NA |

|

7.05% |

$165,960 |

NA** |

NA |

|

8.05% |

$160,530 |

NA** |

NA |

|

8.05% |

$212,430 |

NA** |

NA |

|

8.05% |

$165,960 |

NA** |

NA |

**The monthly payment does not cover the loan’s principal interest, rendering repayment impossible.

Postgraduate Student Loan Debt Repayment Timelines

When indebted students return to school, they may not be required to make payments on any outstanding student loan debts. This does not mean, however, that these debts stop collecting interest. Students seeking postgraduate work may take out additional loans on top of existing student loan debt.

| APR % | Current Debt |

Ultimate Cost |

Time to Zero Debt |

|---|---|---|---|

|

7.05% |

$178,800 |

NA |

NA |

|

8.05% |

$178,800 |

NA |

NA |

| Monthly Payment |

% of Income |

APR % | Current Debt |

Ultimate Cost |

Time to Zero Debt |

|---|---|---|---|---|---|

|

$1,803 |

20% |

7.05% |

$178,800 |

$268,932 |

12 yrs, 6 mos |

|

$2,704 |

30% |

7.05% |

$178,800 |

$227,021 |

7 yrs |

|

$1,803 |

20% |

8.05% |

$178,800 |

$295,122 |

13 yrs, 8 mos |

|

$2,704 |

30% |

8.05% |

$178,800 |

$237,093 |

7 yrs, 4 mos |

| Salary | Monthly Payment |

% of Income |

Total Cost |

Time to Zero Debt |

|---|---|---|---|---|

|

$63,400 |

$528 |

10% |

N/A |

N/A |

|

$63,400 |

$1,057 |

20% |

N/A |

N/A |

|

$63,400 |

$1,585 |

30% |

$362,865 |

19 yrs, 1 mo |

|

$239,200 |

$1,993 |

10% |

$301,085 |

12 yrs, 8 mos |

|

$239,200 |

$3,987 |

20% |

$236,529 |

5 yrs, 0 mos |

|

$239,200 |

$5,980 |

30% |

$222,354 |

3 yrs, 2 mos |

|

$339,470 |

$2,829 |

10% |

$257,873 |

7 yrs, 8 mos |

|

$339,470 |

$5,658 |

20% |

$223,851 |

3 yrs, 4 mos |

|

$339,470 |

$8,487 |

30% |

$214,996 |

2 yrs, 2 mos |

| Salary | Monthly Payment |

% of Income |

Total Cost |

Time to Zero Debt |

|---|---|---|---|---|

|

$63,400 |

$528 |

10% |

NA |

NA |

|

$63,400 |

$1,057 |

20% |

NA |

NA |

|

$63,400 |

$1,585 |

30% |

$439,194 |

23 yrs, 2 mos |

|

$239,200 |

$1,993 |

10% |

$330,990 |

13 yrs, 11 mos |

|

$239,200 |

$3,987 |

20% |

$243,460 |

5 yrs, 2 mos |

|

$239,200 |

$5,980 |

30% |

$226,232 |

3 yrs, 2 mos |

|

$339,470 |

$2,829 |

10% |

$270,559 |

8 yrs, 0 mos |

|

$339,470 |

$5,658 |

20% |

$228,026 |

3 yrs, 5 mos |

|

$339,470 |

$8,487 |

30% |

$217,501 |

2 yrs, 2 mos |

Repayment of Medical and Law School Debt Timelines

The average law school debt is more than four times higher than the average undergraduate student debt. Medical degrees offer a better chance of qualifying for student loan forgiveness if the indebted graduate meets the set of rigid standards to apply.

- Top-earning doctors can have their student loans paid off in a minimum of 7 years and 8 months.

- First-year residents do not earn enough to pay their student loan’s principal interest when paying off lower than 30% of their income.

- $199,220 is the average student loan debt for a medical school graduate.

- $63,400 is a first-year resident’s annual salary.

- $239,200 is a general physician’s salary.

- $339,470 is an anesthesiologist’s salary.

- $140,870 is the average student loan debt for a law school graduate.

- $70,000 is the average starting salary for a law school graduate.

- $145,300 is an average salary for an experienced attorney.

- $186,350 is an average salary for a patent attorney.

| Salary | Monthly Payment |

% of Income |

Total Cost | Years to Zero Debt |

|---|---|---|---|---|

|

$70,000 |

$583 |

10% |

NA |

NA |

|

$70,000 |

$1,167 |

20% |

$246,047 |

17 yrs, 7mos |

|

$70,000 |

$1,750 |

30% |

$191,319 |

9 yrs, 2 mos |

|

$145,300 |

$1,211 |

10% |

$237,774 |

16 yrs, 5 mos |

|

$145,300 |

$2,422 |

20% |

$172,871 |

6 yrs, 0 mos |

|

$145,300 |

$3,633 |

30% |

$160,331 |

3 yrs, 9 mos |

|

$186,350 |

$1,553 |

10% |

$201,816 |

10 yrs, 10 mos |

|

$186,350 |

$3,106 |

20% |

$164,302 |

4 yrs, 5 mos |

|

$186,350 |

$4,659 |

30% |

$155,549 |

2 yrs, 10 mos |

|

Salary |

Monthly Payment |

% of Income |

Total Cost |

Time to Zero Debt |

|

$70,000 |

$583 |

10% |

NA |

NA |

|

$70,000 |

$1,167 |

20% |

$289,663 |

20 yrs, 9 mos |

|

$70,000 |

$1,750 |

30% |

$203,252 |

9 yrs, 9 mos |

|

$145,300 |

$1,211 |

10% |

$274,537 |

18 yrs, 11 mos |

|

$145,300 |

$2,422 |

20% |

$163,700 |

3 yrs, 10 mos |

|

$145,300 |

$3,633 |

30% |

$234,200 |

5 yrs, 5 mos |

|

$186,350 |

$1,553 |

10% |

$217,825 |

11 yrs, 9 mos |

|

$186,350 |

$3,106 |

20% |

$168,526 |

4 yrs, 7 mos |

|

$186,350 |

$4,659 |

30% |

$157,967 |

2 yrs, 10 mos |

Private Student Loan Debt Repayment Timelines

Private student loans, for the most part, come from academic institutions as well as banks and credit unions. The total amount of private student loan debt is difficult to track because little of the related data is a matter of public record.

- 3.85% is the lowest known private student loan interest rate, available only to those with excellent credit.

- 16.49% is the high-end interest rate.

- $8,290 is the average non-federal student loan debt for all completers who attended public institutions.

- $29,200 is the average non-federal student loan debt for all completers who attended private non-profit institutions.

- $9,320 is the average non-federal student loan debt for all completers who attended private for-profit institutions.

| Monthly Payment |

APR % | Average Debt |

Total Cost | Time to Zero Debt |

|---|---|---|---|---|

|

$647 |

3.85% |

$8,290 |

$8,479 |

1 yr, 2 mos |

|

$647 |

3.85% |

$29,200 |

$31,594 |

4 yrs, 1 mo |

|

$647 |

3.85% |

$9,320 |

$9,558 |

1 yr, 3 mos |

|

$647 |

16.49% |

$8,290 |

$9,181 |

1 yr, 3 mos |

|

$647 |

16.49% |

$29,200 |

$45,892 |

5 yrs, 11 mos |

|

$647 |

16.49% |

$9,320 |

$10,457 |

1 yr, 5 mos |

Sources

- PEW Research Center, Student Loan System Presents Repayment Challenges

- CNBC, Resources, This is the average age when people finally pay off their student loans for good

- U.S. Bureau of Labor Statistics (BLS), Learn more, Earn More: Education Leads to Higher Wages, Lower Unemployment

- U.S. Department of Education (ED) Office of Federal Student Aid (OFSA), Federal Student Loan Portfolio

- ED OFSA, The Standard Repayment Plan

- U.S. News & World Report, Law School Benefits Versus Price: The Numbers

- BLS, Occupational Outlook Handbook

- BeMo, How Much Do Residents Make?

- Calculator.net, Student Loan Calculator

- NACE, Graduate Outcomes: Summer 2022 Salary Survey

- Smart Asset, Federal Income Tax Calculator

- National Center for Education Statistics Digest of Education Statistics

- One Wisconsin Now, Twenty to Life: Higher Education Turning Into Multi-Decade Debt Sentence

- Consumer Finance, Debt-to-income calculator tool

- Current Student Loan Interest Rates and How They Work

- Nerd Wallet, Private Student Loans