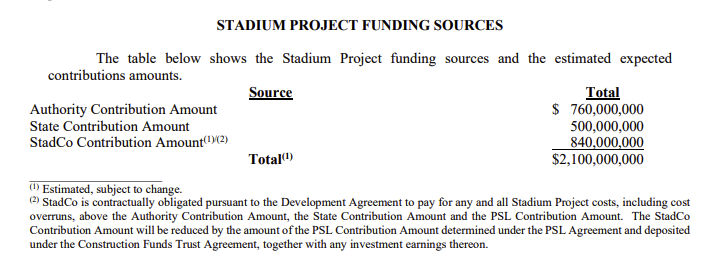

Metro Nashville and the state of Tennessee have successfully secured $1.2 billion to finance a new Tennessee Titans stadium. The city — acting via the Metro Sports Authority — and the state split the debt into six packages, each marked by a different mixture of revenue sources and tax requirements. The state pledged a total of $500 million toward the project, while the city agreed to $760 million.

Close to $1.2 billion in proceeds from bond sales transfer this week to the city and state, which will pass on the money to Regions Bank, the project trustee. According to bond documents, $280 million will be guaranteed by the city’s general fund. The rest of the city’s debt has been commercially insured. Money moves this week also include contributions from the Metro Sports Authority to zero out about $8 million in bonds that remained from the city’s acquisition of the current Titans campus and around $33 million in outstanding debt on Nissan Stadium paid off by the Titans, who will chip in $840 million to the project overall. The Titans expect to cover at least $350 million by issuing a new round of personal seat licenses, a prerequisite per-seat cost for season ticket holders.

Tennessee issued the bonds in two packages: Series 2023A ($452.7 million) and Series 2023B ($44.9 million). The city issued four bond packages: Series 2023A ($345.8 million) backed by revenue pledges, Series 2023B ($79.6 million) backed by revenue pledges, Series 2023C ($59.4 million) backed by the general fund, and Series 2023D ($220.6) backed by the general fund. A combination of hotel taxes, sales taxes, ticket taxes, and team rent are pledged to debt service. All are revenue bonds, meaning regular payments on the debt come from the expected streams of revenue listed above. The full analysis of the sales, linked above, includes additional millions of dollars in costs to originate, issue and market the debt. Goldman Sachs and JP Morgan brokered the debt, while firms like HilltopSecurities, Nixon Peabody LLP, and Bass, Berry & Sims played roles as counsel and advisers throughout the process.

In February, the city received a credit rating upgrade to AA+ from Kroll Bond Ratings Agency. Standard and Poor’s Global Ratings (S&P) upgraded the city to AA+ in July. The state of Tennessee has a perfect AAA credit rating.