U.S. Regulators Want More Control Oversight Into Apple Pay

The United States Consumer Financial Protection Bureau (CFPB) today proposed new oversight requirements for technology companies like Apple that offer digital wallets and payment apps.

According to the CFPB, payment services like Apple Pay are growing in popularity, but the companies behind them are not subject to the same "supervisory examinations" that banks undergo.

The newly proposed rule would require companies that handle more than five million transactions per year to adhere to the same rules as large banks, credit unions, and other financial institutions that are supervised by the CFPB.

The CFPB claims that there have been an increasing number of complaints about tech companies in the consumer finance market, and it argues that examiners should be able to carefully scrutinize the activities of tech companies to ensure they are following the law.

Big Tech and other companies operating in consumer finance markets blur the traditional lines that have separated banking and payments from commercial activities. The CFPB has found that this blurring can put consumers at risk, especially when the same traditional banking safeguards, like deposit insurance, may not apply.

Despite their impact on consumer finance, Big Tech and other nonbank companies operating in the payments sphere do not receive the same regulatory scrutiny and oversight as banks and credit unions. While the CFPB has enforcement authority over these companies, the CFPB has not previously had, inside many of these firms, examiners carefully scrutinizing their activities to ensure they are following the law and monitoring their executives.

The CFPB wants to be able to conduct examinations of tech companies to make sure that they are following funds transfer, privacy, and consumer protection laws, and adhering to the same rules that banks must follow. If finalized, the proposed rule would give the Consumer Finance Protection Bureau more oversight into the financial services provided by companies like Apple and Google.

Popular Stories

Apple will adopt the same rear chassis manufacturing process for the iPhone SE 4 that it is using for the upcoming standard iPhone 16, claims a new rumor coming out of China. According to the Weibo-based leaker "Fixed Focus Digital," the backplate manufacturing process for the iPhone SE 4 is "exactly the same" as the standard model in Apple's upcoming iPhone 16 lineup, which is expected to...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

Israel-based mobile forensics company Cellebrite is unable to unlock iPhones running iOS 17.4 or later, according to leaked documents verified by 404 Media. The documents provide a rare glimpse into the capabilities of the company's mobile forensics tools and highlight the ongoing security improvements in Apple's latest devices. The leaked "Cellebrite iOS Support Matrix" obtained by 404 Media...

If you have an old Apple Watch and you're not sure what to do with it, a new product called TinyPod might be the answer. Priced at $79, the TinyPod is a silicone case with a built-in scroll wheel that houses the Apple Watch chassis. When an Apple Watch is placed inside the TinyPod, the click wheel on the case is able to be used to scroll through the Apple Watch interface. The feature works...

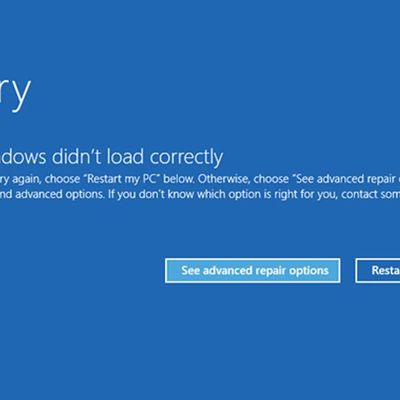

A widespread system failure is currently affecting numerous Windows devices globally, causing critical boot failures across various industries, including banks, rail networks, airlines, retailers, broadcasters, healthcare, and many more sectors. The issue, manifesting as a Blue Screen of Death (BSOD), is preventing computers from starting up properly and forcing them into continuous recovery...

Apple is seemingly planning a rework of the Apple Watch lineup for 2024, according to a range of reports from over the past year. Here's everything we know so far. Apple is expected to continue to offer three different Apple Watch models in five casing sizes, but the various display sizes will allegedly grow by up to 12% and the casings will get taller. Based on all of the latest rumors,...