Apple Reaches Deal With France to Pay Estimated $571M in Back-Taxes

Apple has reached a deal with French authorities to pay an undeclared amount of back-dated tax, according to multiple reports today.

Apple's French division confirmed the tax payment agreement to Reuters, but didn't disclose how much it had agreed to pay, although French media suggest the sum is around 500 million euros ($571 million).

"As a multinational company, Apple is regularly audited by fiscal authorities around the world," Apple France said in a statement. "The French tax administration recently concluded a multi-year audit on the company's French accounts, and those details will be published in our public accounts."

France has been working diligently to stop tech companies like Apple from exploiting tax loopholes in the country. The loopholes are said to have allowed Apple to "minimize taxes and grab market share" at the expense of Europe-based companies.

French President Emmanuel Macron is one of the leaders behind the tax crackdown on international tech companies, with a goal of bringing a more unified corporate tax system across the nineteen euro area states.

As noted by iPhon.fr, Apple and French tax authorities reached the agreement for the payment of several years of unpaid taxes in December, according to French newspaper L'Expansion. The agreement followed a meeting in October between Apple CEO Tim Cook and President Macron, in which both reportedly agreed that a solution would ultimately be enacted by the European Union rather than France.

Apple has had trouble with French tax activist groups accusing the company of wide-scale tax evasion and occupying its Parisian retail stores. In February 2018, Apple sued the activist group "Attac" for its protests in stores, but the High Court of Paris denied Apple's request for an injunction that would have blocked the group from protesting.

Note: Due to the political nature of the discussion regarding this topic, the discussion thread is located in our Politics, Religion, Social Issues forum. All forum members and site visitors are welcome to read and follow the thread, but posting is limited to forum members with at least 100 posts.

Popular Stories

Apple will adopt the same rear chassis manufacturing process for the iPhone SE 4 that it is using for the upcoming standard iPhone 16, claims a new rumor coming out of China. According to the Weibo-based leaker "Fixed Focus Digital," the backplate manufacturing process for the iPhone SE 4 is "exactly the same" as the standard model in Apple's upcoming iPhone 16 lineup, which is expected to...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

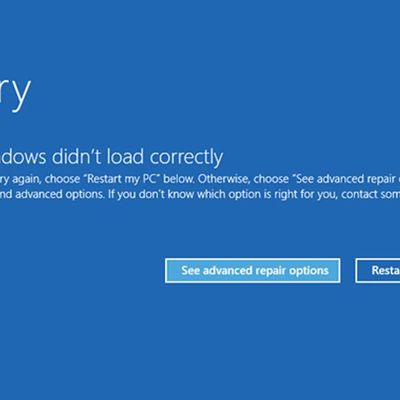

A widespread system failure is currently affecting numerous Windows devices globally, causing critical boot failures across various industries, including banks, rail networks, airlines, retailers, broadcasters, healthcare, and many more sectors. The issue, manifesting as a Blue Screen of Death (BSOD), is preventing computers from starting up properly and forcing them into continuous recovery...

Israel-based mobile forensics company Cellebrite is unable to unlock iPhones running iOS 17.4 or later, according to leaked documents verified by 404 Media. The documents provide a rare glimpse into the capabilities of the company's mobile forensics tools and highlight the ongoing security improvements in Apple's latest devices. The leaked "Cellebrite iOS Support Matrix" obtained by 404 Media...

Apple is seemingly planning a rework of the Apple Watch lineup for 2024, according to a range of reports from over the past year. Here's everything we know so far. Apple is expected to continue to offer three different Apple Watch models in five casing sizes, but the various display sizes will allegedly grow by up to 12% and the casings will get taller. Based on all of the latest rumors,...

If you have an old Apple Watch and you're not sure what to do with it, a new product called TinyPod might be the answer. Priced at $79, the TinyPod is a silicone case with a built-in scroll wheel that houses the Apple Watch chassis. When an Apple Watch is placed inside the TinyPod, the click wheel on the case is able to be used to scroll through the Apple Watch interface. The feature works...