ANZ Eftpos Access Cards Now Support Apple Pay in Australia

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

ANZ is the first bank in Australia to make in-store eftpos mobile payments available to 1.6 million ANZ eftpos Access cardholders through Apple Pay.

Visa, American Express, and MasterCard credit and debit cards issued in Australia by participating banks already supported Apple Pay, but the addition of eftpos is notable as it's widely used in the country.

"Today marks a significant milestone for eftpos as we move from our traditional card based payment method into mobile, enabling consumers with an iPhone or Apple Watch to choose the eftpos account they wish their mobile payment to be made from, being either their eftpos CHQ/SAV account. Customers can set their account preference out of CHQ/SAV and then save themselves entering their account each time they pay. After providing trusted, secure card-based payments for 30 years, eftpos can now also be used to make mobile payments," Mr Jennings said.

"About 1.6 million ANZ eftpos Access cardholders now have the opportunity to make payments on an iPhone or Apple Watch, many of whom may not have had the opportunity to make in store mobile payments before. As Australia's most used debit card network, we are thrilled to be providing ANZ eftpos Access customers with more payment choice, with added benefits of enhanced security and comfort."

As Business Insider points out, support for eftpos reduces fees for both customers and retailers compared to other payment methods.

Support for eftpos is now listed on Apple's Australian Apple Pay website and Apple Pay is available to ANZ Access card customers in Australia immediately.

Popular Stories

Apple will adopt the same rear chassis manufacturing process for the iPhone SE 4 that it is using for the upcoming standard iPhone 16, claims a new rumor coming out of China. According to the Weibo-based leaker "Fixed Focus Digital," the backplate manufacturing process for the iPhone SE 4 is "exactly the same" as the standard model in Apple's upcoming iPhone 16 lineup, which is expected to...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

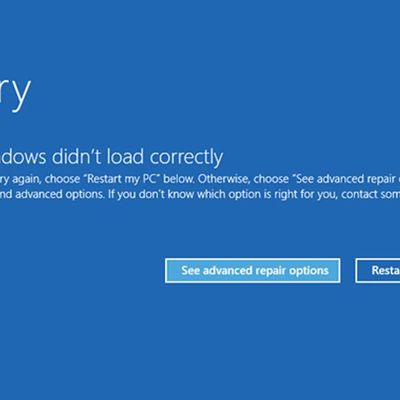

A widespread system failure is currently affecting numerous Windows devices globally, causing critical boot failures across various industries, including banks, rail networks, airlines, retailers, broadcasters, healthcare, and many more sectors. The issue, manifesting as a Blue Screen of Death (BSOD), is preventing computers from starting up properly and forcing them into continuous recovery...

Israel-based mobile forensics company Cellebrite is unable to unlock iPhones running iOS 17.4 or later, according to leaked documents verified by 404 Media. The documents provide a rare glimpse into the capabilities of the company's mobile forensics tools and highlight the ongoing security improvements in Apple's latest devices. The leaked "Cellebrite iOS Support Matrix" obtained by 404 Media...

Apple is seemingly planning a rework of the Apple Watch lineup for 2024, according to a range of reports from over the past year. Here's everything we know so far. Apple is expected to continue to offer three different Apple Watch models in five casing sizes, but the various display sizes will allegedly grow by up to 12% and the casings will get taller. Based on all of the latest rumors,...

If you have an old Apple Watch and you're not sure what to do with it, a new product called TinyPod might be the answer. Priced at $79, the TinyPod is a silicone case with a built-in scroll wheel that houses the Apple Watch chassis. When an Apple Watch is placed inside the TinyPod, the click wheel on the case is able to be used to scroll through the Apple Watch interface. The feature works...

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.

Eftpos, a debit payments network in Australia, today announced that ANZ eftpos Access cards now feature support for Apple Pay.