Apple Files Trademark Application for Apple Pay Cash Peer-to-Peer Payments Service in European Union

Apple has filed a trademark application in the European Union for Apple Pay Cash, the company's new iMessage-based peer-to-peer payments service coming with iOS 11.

Unearthed by tech blog LetsGoDigital, the application was filed with the European Union Intellectual Property Office (EUIPO) on Thursday and is classified as "computer software for use in connection with electronic payment and funds transfers".

By integrating with iMessage in iOS 11, Apple Pay Cash will enable users to make person to person payments right from within chat threads. To send a cash payment, the user authenticates it with Touch ID (or perhaps via facial authentication on the upcoming "iPhone 8") on their iOS device or Apple Watch.

Money received using the service goes on to an auto-generated virtual Apple Pay cash card, similar to a gift card, that gets stored in the Wallet app. The cash card can then be used to make regular Apple Pay purchases at retail stores and on the web. Alternatively, users will be able to transfer the money to an allocated bank account.

Apple has yet to offer further details on how Apple Pay Cash will work, but Brazilian tech blog iHelp BR has uncovered code references in the Apple Pay framework that suggest users will need to authenticate the service with a driver's license or Photo ID before they can send any money through iMessage. This may be done by holding the ID in front of the camera, similar to when adding a bank card to Apple Pay.

While yesterday's trademark application has yet to be granted by the EUIPO, the fact that it has been filed already may mean Apple Pay Cash will go live across EU countries soon after the initial U.S.-only rollout.

Hopefully we'll know more on September 12, when Apple is expected to launch iOS 11 in tandem with new iPhones, new Apple Watches, and possibly a new 4K Apple TV at its fall event, set to take place at the Steve Jobs Theater in Apple Park.

Popular Stories

Apple will adopt the same rear chassis manufacturing process for the iPhone SE 4 that it is using for the upcoming standard iPhone 16, claims a new rumor coming out of China. According to the Weibo-based leaker "Fixed Focus Digital," the backplate manufacturing process for the iPhone SE 4 is "exactly the same" as the standard model in Apple's upcoming iPhone 16 lineup, which is expected to...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

Israel-based mobile forensics company Cellebrite is unable to unlock iPhones running iOS 17.4 or later, according to leaked documents verified by 404 Media. The documents provide a rare glimpse into the capabilities of the company's mobile forensics tools and highlight the ongoing security improvements in Apple's latest devices. The leaked "Cellebrite iOS Support Matrix" obtained by 404 Media...

If you have an old Apple Watch and you're not sure what to do with it, a new product called TinyPod might be the answer. Priced at $79, the TinyPod is a silicone case with a built-in scroll wheel that houses the Apple Watch chassis. When an Apple Watch is placed inside the TinyPod, the click wheel on the case is able to be used to scroll through the Apple Watch interface. The feature works...

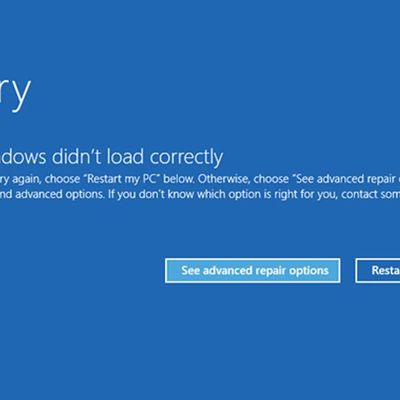

A widespread system failure is currently affecting numerous Windows devices globally, causing critical boot failures across various industries, including banks, rail networks, airlines, retailers, broadcasters, healthcare, and many more sectors. The issue, manifesting as a Blue Screen of Death (BSOD), is preventing computers from starting up properly and forcing them into continuous recovery...

Apple in 2025 will take on a new compact camera module (CCM) supplier for future MacBook models powered by its next-generation M5 chip, according to Apple analyst Ming-Chi Kuo. Writing in his latest investor note on unny-opticals-2025-business-momentum-to-benefit-509819818c2a">Medium, Kuo said Apple will turn to Sunny Optical for the CCM in its M5 MacBooks. The Chinese optical lens company...