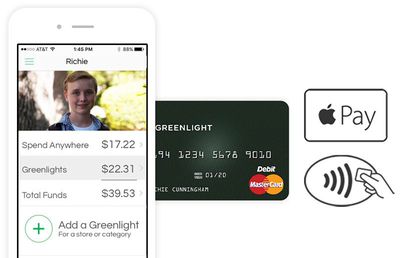

Greenlight today announced that its smart MasterCard debit card for kids now supports Apple Pay and can be used in over 120 countries.

Greenlight is a MasterCard debit card for kids that parents can manage using their smartphones. Parents can top up the card with money instantly, from anywhere, and then specify the exact stores where a child can spend. There's also a Spend Anywhere tab for parents that trust their children's spending habits.

With Apple Pay support, kids no longer have to carry the physical debit card on them, and can simply pay using their iPhone or paired Apple Watch. The card can be set up through the Wallet app on eligible devices.

Every transaction is recorded in the Greenlight app [Direct Link] for iPhone and iPad, and parents receive instant notifications on where and when a child spends, or tries to spend. The card, protected by a PIN number, can be toggled on or off entirely as well, particularly in the event that it's lost or stolen.

For added assurance, Greenlight cards can not be used to withdraw cash at an ATM or get cash back from a purchase. The card also can not be used at any store or website in the categories of wire transfers, money orders, escort services, massage parlors, lotteries, gambling, horse racing, and dog racing.

Greenlight accounts are FDIC insured in the United States through the company's partner Community Federal Savings Bank.

Greenlight costs $4.99 per month, with a free 30-day trial available. Beyond the monthly charge, there are generally no additional fees.

Parents interested in a similar Visa option can look into the recently launched Current smart debit card for kids.

Top Rated Comments

Now that being said, we signed on to PNC Bank's (Pittsburgh) digital wallet program. Kid get three "accounts" (spend, save, grow) plus a debit/visa card that can be used for payment or at PNC ATMs. Kid also gets a very useful iPhone app (that works on her hand-me-down iPhone 5S) to track spending and budgeting. And perhaps most importantly, parent gets the same info in his PNC app, so he can track his kid's spending habits, easily transfer money to her, and set certain limits where needed. All at no charge. Bummer, no ApplePay...we'll survive. I've had ApplePay for 6 months and have only been in one store that uses it.

Not sure why we want to complicate things that don't need to be complicated. Debit cards, credit cards, Apple Pay for children. WTF? How about take your kids shopping and understand what they are into instead of wonder what that $50 hit on Apple Pay was. More responsibility punting by parents.

I have 2 dollars in my wallet, which is 2 dollars more than I usually have. I use a credit card to pay for everything I possibly can. 800+ FICO score, never paid a dime in interest. Dave Ramsey's advice is for idiots without any self control.