Barclays Anticipating 'Imminent' Support for Apple Pay in United Kingdom

MacRumors has learned that a high-level executive at Barclays, one of the largest banks in the United Kingdom, anticipates "imminent" support of Apple Pay in the country. Apple Pay in the U.K. is expected to go live on Tuesday, although it remains unclear if Barclays will be a first wave launch partner because of its delayed negotiations with Apple about the mobile payments service.

Apple confirmed at WWDC last month that Apple Pay will be available in the U.K. in July, but stopped short of providing a specific launch date. Recently released employee training documents have suggested the launch could come next week, on July 14, and some Santander customers were able to add their cards to Passbook for use with Apple Pay and make purchases ahead of that date.

Barclays was notably absent from Apple's list of banks that will support Apple Pay in the U.K. at launch or soon after, which presently includes HSBC, Lloyds Bank, Bank of Scotland, Royal Bank of Scotland, First Direct, Halifax, M&S Bank, MBNA, NatWest, Nationwide, Santander, TSB and Ulster Bank. The bank's subsidiary Barclaycard has offered an Apple Rewards Visa Card for several years.

Barclaycard recently expanded its "bPay" lineup of wearable solutions for contactless payments to include a wristband, key fob and sticker, leading to speculation that Barclays may be electing to use its own mobile payments services as opposed to Apple Pay, similar to how some retailers maintained exclusivity to the CurrentC platform last year. Today's confirmation, however, indicates otherwise.

Popular Stories

Apple will adopt the same rear chassis manufacturing process for the iPhone SE 4 that it is using for the upcoming standard iPhone 16, claims a new rumor coming out of China. According to the Weibo-based leaker "Fixed Focus Digital," the backplate manufacturing process for the iPhone SE 4 is "exactly the same" as the standard model in Apple's upcoming iPhone 16 lineup, which is expected to...

Key details about the overall specifications of the iPhone 17 lineup have been shared by the leaker known as "Ice Universe," clarifying several important aspects of next year's devices. Reports in recent months have converged in agreement that Apple will discontinue the "Plus" iPhone model in 2025 while introducing an all-new iPhone 17 "Slim" model as an even more high-end option sitting...

Apple typically releases its new iPhone series around mid-September, which means we are about two months out from the launch of the iPhone 16. Like the iPhone 15 series, this year's lineup is expected to stick with four models – iPhone 16, iPhone 16 Plus, iPhone 16 Pro, and iPhone 16 Pro Max – although there are plenty of design differences and new features to take into account. To bring ...

Apple is scaling back its Hollywood spending after investing over $20 billion in original programming with limited success, Bloomberg reports. This shift comes after the streaming service, which launched in 2019, struggled to capture a significant share of the market, accounting for only 0.2% of TV viewership in the U.S., compared to Netflix's 8%. Despite heavy investment, critical acclaim,...

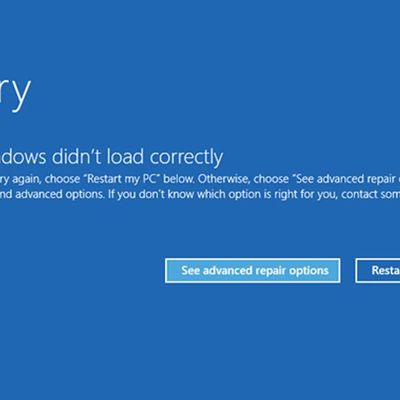

Last Friday, a major CrowdStrike outage impacted PCs running Microsoft Windows, causing worldwide issues affecting airlines, retailers, banks, hospitals, rail networks, and more. Computers were stuck in continuous recovery loops, rendering them unusable. The failure was caused by an update to the CrowdStrike Falcon antivirus software that auto-installed on Windows 10 PCs, but Mac and Linux...