Why invest in Continental?

The Equity Story of Continental

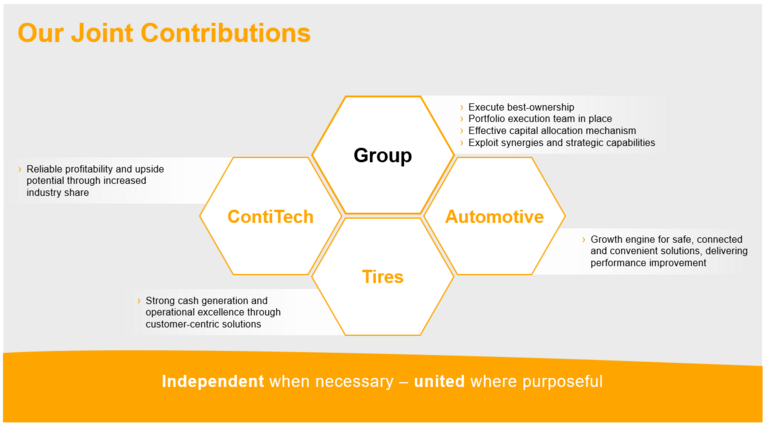

We have strong and unique assets in this group.

- Top in Tech where it counts

- Value creation upside generated by tangible performance improvements

- Determined team - decisive, execution and performance driven

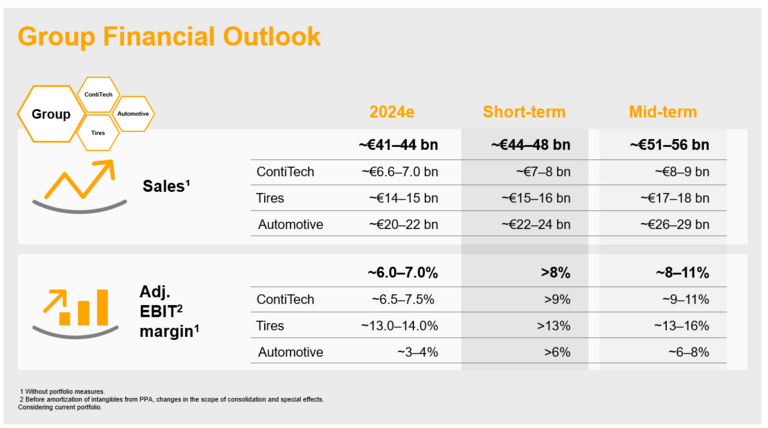

We have clear mid-term targets.

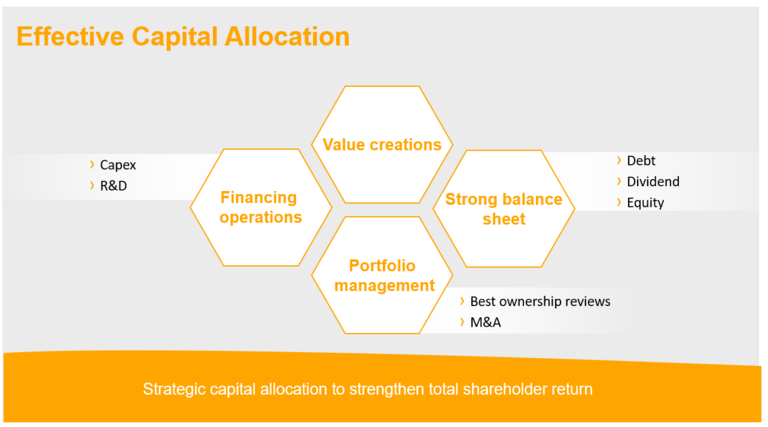

Sharpened capital allocation in place.

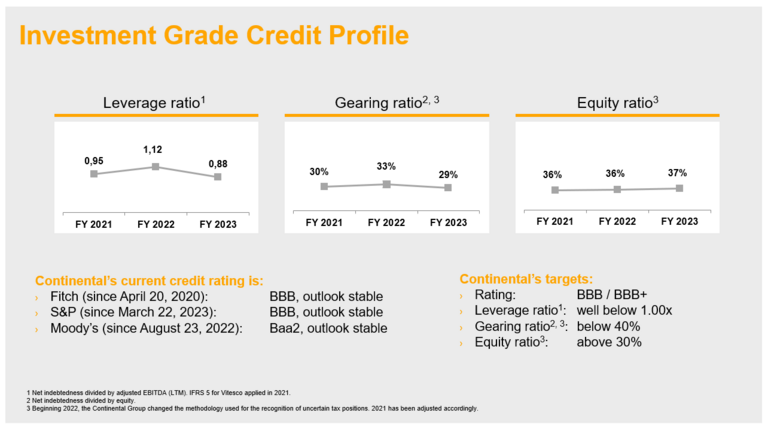

We are committed to keep our investment grade at BBB/BBB+ in the mid-term.

To keep our gearing ratio below 40% mid-term.

To have an equity ratio of more than 40%.

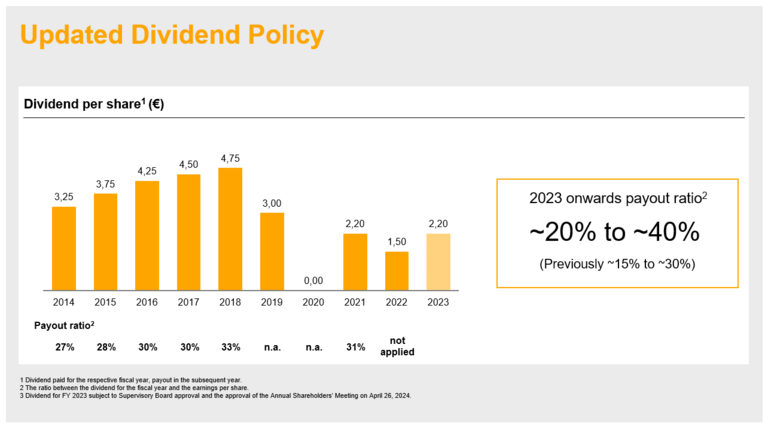

Dividend payout reflects commitment to our dividend policy.

The corridor for dividend distributions has been increased to around 20 to 40 percent of net income (previously: around 15 to 30 percent).

Our ambitions for a sustainable future.

Guiding rails in a complex environment.