In a remote tropical forest in Indonesia’s Spice Islands, villagers planned their last stand.

A foreign gold-mining company was preparing to gouge out a massive pit from the mountain that had sustained these farmers and fishermen for generations. To protect their way of life, the villagers planned to hike to the summit and refuse to leave.

Newcrest Mining had won the right to explore this mineral-rich area during the 30-year rule of Suharto, Indonesia’s military dictator. But when mass protests swept Suharto from power, the new parliament outlawed the environmentally devastating open-pit mining method in certain areas like this one, where it could endanger the water supply.

Newcrest, however, was proceeding as if the new law didn’t apply — because, effectively, it didn’t. The Australian company had found a way to trap Indonesia in the deals of the deposed dictator and, in the process, reap huge profits.

The weapon that Newcrest and other powerful foreign mining companies wielded was a threat. A highly specialized legal threat: They warned they might haul Indonesia before a sort of private global super court. Though most people have never heard of it, this justice system has the power to make entire nations fork over hundreds of millions or even billions of dollars to companies that say their business was unfairly hampered.

Known as investor-state dispute settlement, or ISDS, this legal system is written into a vast network of treaties that set the rules for international trade and investment. It is as striking for its power as for its secrecy, with its proceedings — and in many cases its decisions — kept from public view. Of all the ways in which ISDS is used, the most deeply hidden are the threats, uttered in private meetings or ominous letters, that invoke those courts. The threats are so powerful they often eliminate the need to actually bring a lawsuit. Just the knowledge that it could happen is enough.

The threats are so powerful they often eliminate the need to actually bring a lawsuit. Just the knowledge that it could happen is enough.

An 18-month BuzzFeed News investigation into ISDS for the first time casts a bright light on the use of these threats. Based on reporting from Asia, Africa, Central America, and the US; interviews with more than 200 people; and inspection of tens of thousands of pages of documents, many of which have never before been made public, the series has already exposed how executives accused or convicted of crimes have turned to ISDS to help them get off the hook. Stories later this week will show how some financial firms have used ISDS to protect their most controversial and speculative practices and how the US, a major booster of the system, is surprisingly vulnerable to ISDS suits. Today’s story reveals how corporations have turned the threat of ISDS legal action into a fearsome weapon, one that all but forces some of the countries where these corporations operate to give in to their demands.

ISDS was originally devised as a forum in which to resolve conflicts between countries and the foreign companies that do business within their borders. But the system puts countries at a striking disadvantage.

Only companies can bring suit. A country can only defend itself; it cannot sue a company. Arbitrators who decide the cases are often drawn from the ranks of the same highly paid corporate lawyers who argue ISDS cases. These arbitrators have broad authority to interpret the rules however they want, without regard to precedent and with almost no public oversight. Their decisions carry extraordinary power. Often, countries are obligated to obey ISDS judgments as if they came from their own highest courts. And there is no meaningful appeal.

ISDS is so tilted and unpredictable, and the fines the arbitrators can impose are so catastrophically large, that bowing to a company’s demands, however extreme they may be, can look like the prudent choice. Especially for nations struggling to emerge from corrupt dictatorships or to lift their people from decades of poverty, the mere threat of an ISDS claim triggers alarm. A single decision by a panel of three unaccountable, private lawyers, meeting in a conference room on some other continent, could gut national budgets and shake economies to the core.

ISDS was once an obscure quirk of international law, but it has exploded in recent years, as elite law firms have devised new and creative ways to deploy it. They have used ISDS to punish nations for limiting profits during economic crises, reforming tax and environmental regulations, or prosecuting executives accused of crimes.

But those are cases that actually proceeded all the way to arbitration. Often, say lawyers who are involved in the system, the mere threat of an ISDS claim is enough to achieve the same results. It’s like flashing a gun at a tense negotiation — better not to use it, but the guys across the table know it’s there.

“I do a ton of work that involves threatened claims that never go to arbitration,” said Michael Nolan, a partner in the Washington, DC, office of Milbank, Tweed, Hadley & McCloy. “That’s much more common,” he said. “It’s much better to get things done quietly.”

“Every month I get a threat,” said Marie Talasova, a top lawyer for the Czech Republic’s Ministry of Finance. “We have to review the risks, how strong the claim is. We try to minimize the costs of the state.”

The power of such threats is at the heart of political debates over ISDS. Academics and activists argue that, behind closed doors, businesses can brandish the threat of ISDS to halt or roll back legitimate public-interest laws. These threats, they argue, are a much greater danger than the sliver of cases that go to arbitration and make it into public view. Supporters of ISDS shoot back, where's the proof?

It's hard to come by. In fact, a recent study for the Dutch government called finding such proof “nearly impossible.” The lawyers involved almost always have pledged confidentiality to their clients, and the threatened governments — afraid of appearing weak or sparking a public backlash — are loath to admit they capitulated. In fact, many ISDS supporters flatly say it never happens.

“Some people say states are always getting screwed or their public policy initiatives are being frozen because they’re scared of investment arbitration,” said Jan Paulsson, a legend in ISDS circles who has worked as a lawyer or arbitrator in dozens of cases. “I’d like somebody to show that to me. I’d really like somebody to show me an example where that happened.”

In government and corporate offices in Jakarta and the tropical forests of the Spice Islands, BuzzFeed News found that not only can it happen, it did. With grave consequences. This is how.

For decades, Suharto and big mining companies had a good thing going. The general turned dictator didn’t worry much about the environment or indigenous people, and the mining industry’s spoils helped fill his regime’s coffers.

To keep it all running smoothly, his government had created a kind of one-stop shop to award lucrative contracts: favorable terms, few hassles. “If you have a problem,” such as uncooperative locals, recalled Ketut Wirabudi, who worked in the mining industry during that era, “you give a donation to the military, and they solve the problem.”

The companies “just did whatever they want,” said Rachmat Witoelar, a recent minister of environment.

So when the post-Suharto government enacted a forestry law that forbade open-pit mining in some areas, mining companies fought back, arguing that the law violated contracts they had signed under Suharto.

In a statement to BuzzFeed News, Newcrest at first said it “is not aware of any threats/ISDS action made in relation to the enforcement of the 1999 forestry law.” But Syahrir AB, who at the time was a Newcrest executive in Indonesia, was unequivocal: “My company, Newcrest," made that threat, he said in an interview in Jakarta.

He himself had delivered the company’s “message to the government” during a meeting with mining ministry officials, he recalled. “If we cannot mine in this area,” he remembered telling them, “we will wash our hands [of] Indonesia and go to international arbitration.” The message was clear: Indonesia would be sued, perhaps for hundreds of millions of dollars.

Told what Syahrir said, a Newcrest spokesman wrote that the company “is not aware” Syahrir had made the threat, adding that “it is not something that we would condone.”

Interviews with current and former officials from multiple government ministries, four mining companies, and the industry’s lobbying association, as well as thousands of pages of documents reviewed by BuzzFeed News show that other foreign mining giants privately made similar threats, warning that they would sue Indonesia for billions of dollars in damages if the country tried to make them follow the new environmental law.

Their billion-dollar ultimatum was no idle threat. As the mining companies knew well, Indonesia was still reeling from another staggering judgment.

That case involved the Karaha Bodas Company, which had contracted with companies owned by Indonesia to build a geothermal power plant. The Asian currency crisis struck not long after the deal was signed, and the government put that and many other projects on hold.

But unlike most other affected companies, Karaha Bodas, primarily owned by two US energy firms, went to international arbitration. The tribunal awarded it $261 million, despite the fact that the company had not yet sunk even half that amount into the project. The bulk of the award was for the loss of future profits — potential future profits, which no one could prove would actually have accrued.

In other words, Indonesia owed a quarter-billion dollars to a private company for electricity it would never receive, from a power plant that hadn’t been built, all while it was battling a historic financial crisis. When the government resisted paying, Karaha Bodas filed to seize Indonesian assets around the world. The company did not respond to requests for comment.

The country stood to lose half its entire annual budget.

The mining companies brought up this painful episode in meetings, former government officials recalled. The government got the point. “Because of this bitter experience, we tend to find solutions,” said M.S. Kaban, who became minister of forestry in 2004.

And this time, the potential losses were much bigger — as much as $22.7 billion if some of the biggest mining companies sued, according to a government analysis obtained by BuzzFeed News. That was about half of the previous year’s budget for the entire government.

Stuart Gross, an American lawyer who advised local environmental groups, said he believed Indonesia could have beaten the mining companies in arbitration but still wasn’t sure what he would have done if he’d been in the president’s position.

“The liability that these mining companies were talking about was in the billions,” he said. “Indonesia just doesn’t have that kind of capital. It’s crippling. This threat had no legal merit, but because of the consequences and the way these cases are adjudicated — by a private panel without appeals — that threat is very effective.”

He added, “A country like Indonesia, unless it’s got a backbone of steel, when faced with one of these threats, is likely going to cave.”

Under cover of night, the villagers picked their way through the tropical forest in the Spice Islands, bound for the summit of the mountain Newcrest wanted to carve out.

The villagers had depended on that mountain, along with the forest and the waters surrounding it, for generations. It was where they cultivated coconut, cassava, jackfruit, and cocoa; hunted deer and wild pigs; drew water and harvested fish; and gathered the cloves and nutmeg that had first made this unforgiving territory a prize for colonial powers.

“Our elders told us to guard this location,” said Petrus Kakale, who had tended a plantation of clove trees on the mountain for 40 years.

But that night, in January 2004, someone else was guarding it: members of the Brimob, Indonesia’s infamous paramilitary police.

The villagers hoped to slip past the Brimob in the middle of the night by splitting into smaller groups that would converge on the summit. But, in the early morning hours, these plans dissolved, according to interviews with five people who participated in the demonstration and an investigation report, never before made public, by the Indonesian government’s independent human rights agency.

Dozens of villagers, led by a young farmer and protester named Fahri Yamin, had made it part of the way up the mountain when Brimob officers brandishing rifles told them to turn back. Fahri said he refused. “We only demand our rights,” he recalled telling the officers.

The Brimob ordered the villagers to the ground and beat them with heavy sticks and the butts of their rifles. The officers shoved Fahri, his hands bound and a few teeth knocked out, into the back of a vehicle and sped off toward Newcrest’s offices.

Another group of villagers, led by a farmer named Salmon Betek and village priest Pordenatus Sangadi, had made it farther up the mountain before encountering the Brimob. The officers herded the group to the summit — once a forest, now cleared in preparation for mining — and ordered them to lie on the ground. Here, too, the Brimob beat the villagers with heavy sticks and rifle butts, fracturing ribs and opening gashes on heads.

Then, the commander stepped forward. He pointed his pistol just above Salmon’s head and squeezed the trigger.

Salmon said he heard the bullet scream by, then the horrified cries of his neighbors. He turned his head, he recalled, and saw the man just behind him slumped on the ground, shot in the forehead.

Group leaders including Fahri and Pordenatus said the Brimob took them first to Newcrest offices nearby for interrogations, then flew them on a company helicopter to a nearby island where they were jailed without being told why.

In its statement, Newcrest said it “had no authority over” the Brimob’s actions but that it paid police expenses in accordance with “standard practice in Indonesia.” The company also said its helicopter was not used to transport community members.

Some were released after a few days, but Fahri said he was jailed for 44 days. His wife and 2-month-old son were allowed to see him once a week, traveling hours for their few minutes of allotted visitation.

It’s unclear what offenses, if any, the protesters were charged with. An official at the local court clerk’s office said she could find no record of any charges filed against the men.

But the detained men said that, based on their interrogations and other dealings with authorities, the message was clear: Stop protesting.

A Newcrest spokesman told reporters at the time that the company regretted that the shooting had occurred, but said, “It's really in a sense nothing to do with Newcrest although it did happen on our site.”

And as for the villagers, Newcrest said a lot were not protesting — they were stealing. “Many of the protestors were people who were illegally mining,” Newcrest said in its statement to BuzzFeed News.

The Brimob commander got off with probation after two of his subordinates told a court that the shooting was an accident. But investigators for the government’s human rights agency found that authorities had illegally detained people, tortured them, and murdered one. The findings also raised broader concerns: that the government had violated the people’s economic, social, and cultural rights in allowing Newcrest to mine the sensitive forest area.

The agency wanted the government to re-evaluate the company’s permit.

But human rights agencies had only the power to recommend. Foreign businesses had the power to sue for billions.

Two months after violence broke the will of the villagers, the ISDS threats broke the will of the Indonesian government.

The nation’s president issued an emergency decree that, combined with a follow-up edict, exempted Newcrest and 11 other mining companies from the new environmental law.

Soetisna Prawira, the mining ministry’s top lawyer at the time, said he helped draft the decree to avoid the potentially catastrophic costs of ISDS claims.

“This is the pressing emergency circumstance: the fact that companies will bring the case to international arbitration,” Soetisna said. "Arbitration is the only reason" that Indonesia issued the decree.

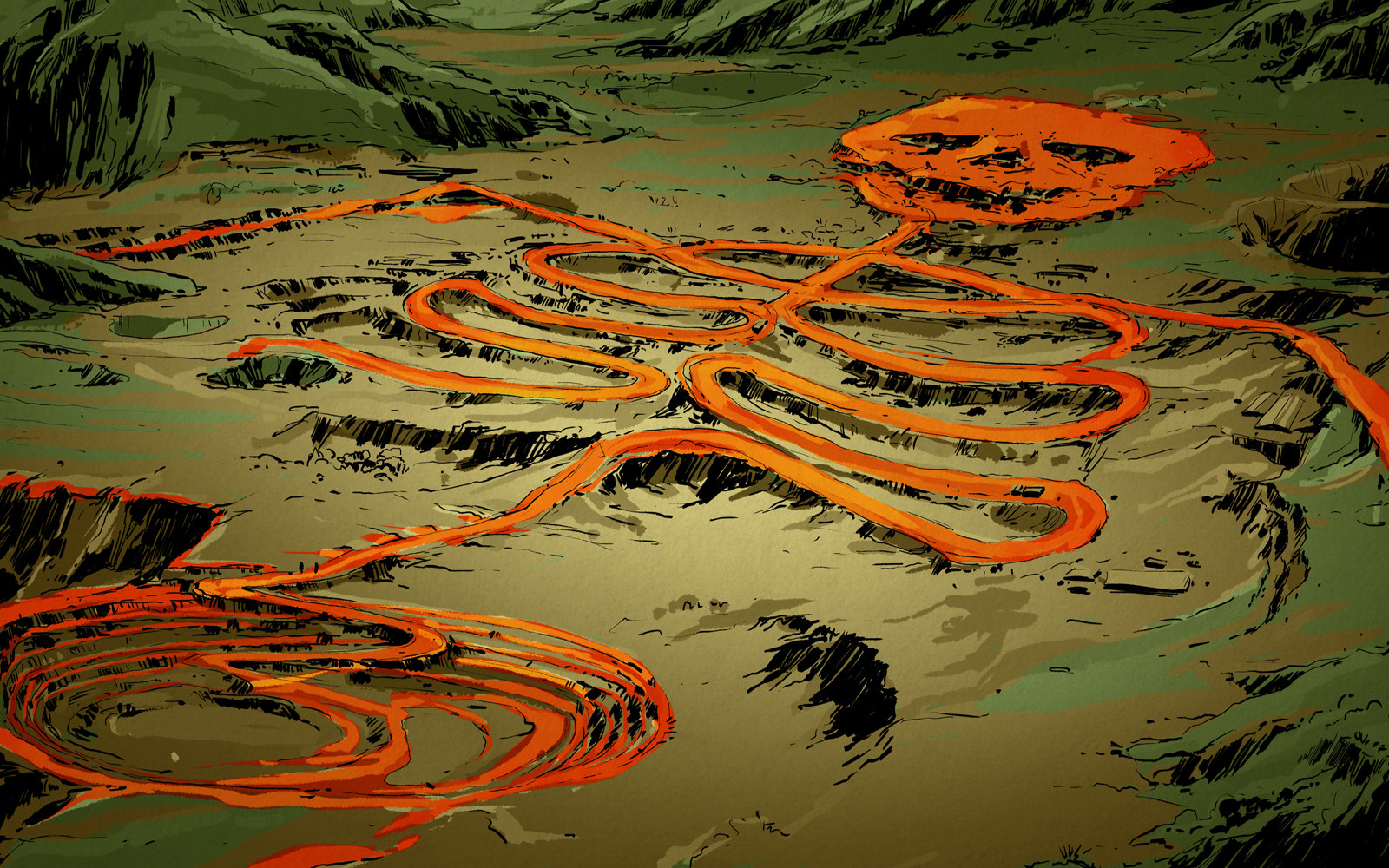

By late 2006, the gold was gone, and the mountaintop was a cavernous pit.

He added, “Under such circumstances, we had no choice.”

Parliament still had to sign off on the arrangement. Environmental groups, scientists, and academics urged legislators not to approve the decree, warning that open-pit mining in protected forests not only would destroy a precious resource but would also contaminate people’s water and expose them to landslides and floods. One politician implored his colleagues to stand firm, saying, “We do not need to be haunted by arbitration.”

But, in meetings and hearings, legislators fretted over the possibility that the nation would lose another financially devastating case.

During a hearing, the forestry minister called international arbitration a “real threat” that “compelled” Indonesia to grant the mining companies’ wishes. Then another minister invoked the Karaha Bodas debacle and said that if Indonesia did not satisfy their demands, the country would "face a similar situation.”

Newcrest’s Syahrir and officials from four other mining companies spoke at the hearings, and one warned lawmakers that if they didn’t sign off on the decree, they should “prepare for a depleted state budget.”

On July 15, 2004, parliament gave Newcrest and the other mining companies what they wanted, voting to approve the decree and allow the companies to carve up protected forests.

Today, 8 of the 12 companies given exemptions have mined in protected forest areas, according to the mining ministry. When they finish, they are supposed to restore the land.

Newcrest wasted little time getting started. Soon after the parliament voted, the company reported that it had dug out and sold more than $30 million worth of gold from the mountain and told investors this was a key reason for the year’s “much improved profit figure.” The following fiscal year, the mountain yielded upwards of $90 million worth of gold for Newcrest.

By late 2006, the gold was gone, and the mountaintop was a cavernous pit.

When some governments around the world have sought to unwind the destructive legacies of dictators or modernize their laws, they’ve arrived at a similar quandary to Indonesia’s: ISDS gives companies a powerful tool to preserve the advantages they won under the old regime.

In the wake of the Arab Spring, for example, Libya has faced claims over contracts from the time of Muammar al-Qaddafi. Egypt has been flooded with claims by companies that got special treatment from the Hosni Mubarak regime, some of which have used ISDS to help extract payouts and other concessions.

The dominant view in ISDS circles is that a deal’s a deal. Unless there’s solid proof that the deal was obtained illegally, it doesn’t matter how immoral, incompetent, or kleptocratic the leader who signed it might have been or how much the arrangement harms the average citizen. International law, they say, depends on that approach.

“The people already have suffered from having had the authoritarian regime,” said Paulsson, the ISDS lawyer and arbitrator. The effects of whatever contracts that regime handed out “will be one more thing that they suffer as a result of it. The people who were killed by that dictator remain dead. The poor deals that were made under his offices are there. They have created debts. So let’s not pretend that they’re not debts because, if we do, we do that at the cost of destroying commercial certainty.”

For years, some African nations have seen their mineral wealth flow abroad to private companies, even as some of these nations’ own citizens remained in abject poverty, thanks in large part to bad deals cut by leaders who either got outmaneuvered or were out to enrich themselves. Now international organizations including the United Nations are trying to help some of these countries get their fair share, largely by updating their tax codes and other laws.

But companies are using ISDS to undermine those reforms, suing even impoverished countries that try to raise tax revenue, according to sustainable development organizations and a recent report by the South Centre, a Geneva-based research group.

Indeed, some ISDS lawyers have alerted corporate clients that their services are “more important than ever,” as a leading London firm put it. In a 2014 presentation, the firm gave businesses a playbook for simultaneously minimizing taxes and ensuring they can sue if governments update their tax laws.

When Algeria passed a law taxing windfall profits, Maersk Oil claimed the tax amounted to a “breach of contract” and used ISDS to reach a settlement that the company said would provide it about $920 million in benefits. When Uganda tried to collect a tax bill of more than $400 million from Tullow Oil, the UK company claimed it was exempt and filed an ISDS claim. In a settlement, Uganda agreed to knock $150 million off that sum. In response to questions from BuzzFeed News, Tullow referred back to a statement it made at the time, describing the settlement as “good news for Tullow and Uganda.” Maersk also referred back to a previous press release, in which the company’s CEO called the settlement “a solid basis for moving ahead with our Algerian activities.”

And ISDS has put Romania in a no-win situation because it tried to follow European Union laws. During its struggling, newly post-communist days, the government had enacted a set of generous tax incentives. When it was trying to join the EU, it was instructed to end those incentives, which the European authorities regarded as “illegal state aid.” After the government did just that, the owners of a food manufacturing business — Romanian-born twin brothers who became Swedish citizens — filed an ISDS claim in 2005.

The European Commission told the tribunal that the tax incentives violated EU law. Unmoved by that fact, the tribunal awarded those brothers about $250 million. And when the European Commission ordered Romania not to pay, the brothers moved to seize Romania’s overseas assets. In a statement, the brothers’ company, European Food SA, said the tribunal’s award was justified because Romania owed the company damages for removing the incentives.

These and many other cases reflect a fundamental shift that has given heft to the mere threat of a claim. The system was set up to ensure that businesses don’t suffer outright property seizures or blatant discrimination, according to those who have studied its origins. But today the majority of ISDS cases are not about this type of egregious government behavior; they’re about government actions — many of them ordinary and similar to those taken by developed and democratic governments — that businesses contend are unfair. Some arbitrators now regard the system as protecting not just the rule of law but also business’ “legitimate expectations” and even a “reasonable rate of return on investment.”

“The ISDS regime reaches far beyond its original intention,” the UN’s trade and development body wrote in a recent report. The system today suffers from a “lack of coherence, consistency and predictability” that “raises systemic concerns,” the agency wrote in another report.

So it’s hardly a surprise that just the threat of an ISDS claim can rattle a government.

The executives terminated the interview. “You never met us,” one of them said.

“Some governments I’ve worked with have been very hesitant to push for changes that were very much needed because they were afraid of arbitration,” said Lou Wells, a longtime professor at Harvard Business School who has advised developing countries throughout the world.

In publications for current or potential clients, lawyers at major firms tout ISDS threats as effective. For example, a publication from Crowell & Moring noted, “Indeed, for every investor-State case that goes through to completion, there are several instances” in which companies used investment treaties “as leverage to negotiate with the host government and cause it to change its behavior more quickly and less expensively.”

Today in Indonesia, 18 years after Suharto resigned, the government is still trying to untangle itself from deals his regime struck decades ago, but it keeps encountering ISDS.

In 2009, parliament voted to implement a licensing process for mining companies that would bring Indonesia more in line with developed nations. As it took effect, one American company responded by filing an ISDS claim; another responded by raising that possibility.

Two top officials for the mining association — executive director Syahrir, the former Newcrest executive, and Martiono Hadianto, the association’s chairman at the time — insisted during a recent interview that the old system should remain in place, as it made mining companies and the government equal business partners.

But after speaking with BuzzFeed News for an hour, Syahrir and Martiono demanded to see this article before publication. BuzzFeed News refused, and the two men walked out of the interview, with Syahrir stating, “You never met us.” The mining association followed up with a letter saying it had “decided that the interviews was [sic] never happened.”

By 2012, the Indonesian government had seen enough. It launched a review of its treaties containing ISDS and began consulting experts around the world. It now has canceled more than 20 investment treaties in hopes of renegotiating them on more equitable terms, said Abdulkadir Jailani, an official from the Ministry of Foreign Affairs who is leading the review.

“I personally think that an investment protection regime is very necessary in international law,” Abdulkadir told BuzzFeed News. “The key is to strike a balance between protection and the right to regulate.”

Indonesia is part of a growing list of countries that are trying to renegotiate or nullify treaties containing ISDS. Some Latin American countries, particularly Ecuador, Venezuela, and Bolivia, have taken the hardest line, denouncing the entire system, terminating treaties, or withdrawing membership from the World Bank’s arbitration body.

Other nations have adopted a less drastic approach. After a controversial challenge to a post-apartheid law designed to remedy years of discrimination against black people in business, South Africa terminated its treaties and replaced them with a more limited domestic law protecting foreign businesses. India is seeking to renegotiate its treaties after being hit with controversial cases, some of them related to a notorious corruption scandal, others to the government’s attempts to crack down on tax avoidance.

Developed countries also have joined the backlash. Australia has refused to include ISDS in some of its recent treaties. The European Commission has proposed turning ISDS into an Investment Court System with a panel of potential arbitrators pre-selected by governments and a genuine appeals process. Canada recently agreed to this in a trade deal with the EU states.

The United Nations Conference on Trade and Development (UNCTAD) was once a big booster of ISDS, even hosting events that amounted to international treaty speed-dating, at which diplomats would meet their counterparts from other countries, go through rounds of negotiations, and emerge from the gathering with multiple new treaties.

In recent years, however, it repeatedly has sounded the alarm. “The continuing trend of investors challenging generally applicable public policies, contradictory decisions issued by tribunals, an increasing number of dissenting opinions, concerns about arbitrators’ potential conflicts of interest all illustrate the problems inherent in the system,” a 2013 report said.

“The question is not about whether to reform,” UNCTAD said in a report this year, “but about the what, how and the extent of such reform.”

The most outspoken defenders of ISDS often are lawyers and arbitrators. “The system is not broken,” said Charles Brower, who long has been one of the most in-demand arbitrators and is almost always appointed to the panels by businesses. The system’s critics, he said, are primarily “NGOs and the populist politicians who don’t know what they’re talking about.”

Melaki Sekola hopped effortlessly from one rock to the next, crossing the river near his farm in the shadow of the mountain that his ancestors had named Toguraci — “place of gold” in the local language — long before Newcrest arrived.

For generations, the forest had supported his tribe, the Pagu, and his village of maybe 100 people. The small house he built — crooked wood bound together with cable and nails; mostly dirt floor; and a roof of dried leaves — is home to his wife, six children, and three grandchildren.

Dressed in black wading boots, ripped cargo shorts, and a mud-stained yellow shirt, Melaki bounded up a rocky path and paused.

A vast, charcoal-colored lake spread out before him. Much of it was caked over, a crack-filled coating baked by the equatorial sun. In the distance, a black pipe spewed dark liquid.

This is where Newcrest dumps its waste. When the company clawed out and ground up much of Toguraci, it separated out the gold using cyanide and discharged the leftovers here. And it has continued dumping waste here from newer, underground mines.

Melaki scampered down the embankment and arrived at a river. He pointed to a creek flowing into the river from the direction of Newcrest’s inky lake — one conduit for mine waste to enter the village’s water supply, he said.

“We used to have a lot of fish here,” he said. “Now the water will make our skin itch.”

These are common complaints among the people in this cluster of villages where blackouts are frequent, malaria is endemic, and the traffic on the few roads consists mostly of trucks bound for the mine and the jacked-up tactical vehicles of local authorities.

Something is wrong with the water, the people who live here say, and the problems started when mining began. Many won’t bathe in the rivers anymore; the water causes rashes. Most of the fish in the rivers and the nearby bay have died off, effectively killing the industry that had fueled the local economy. And they don’t dare drink from the rivers as they once did.

Six years ago, a researcher from a prominent Indonesian university came to this remote area and tested the fish that remained at deeper levels in the bay. The fish contained so much cyanide — a poisonous chemical that Newcrest uses in its mining processes — that they “could harm the health” of people who ate them, the scientist found.

Said Basalamah, the government official in charge of environmental monitoring for the province, said his office doesn’t have evidence of serious water pollution, but he acknowledged that the ministry’s “sampling is not yet representative if we want to get the real picture of environmental conditions around the mining area.” He said he was unaware that a published study had found serious cyanide contamination.

Newcrest said that its Indonesian subsidiary and the government have investigated local villagers’ claims of health and environmental problems but “found no evidence to support the allegations.” The company also said it complies with Indonesian environmental and water-quality regulations.

Near his farm, Melaki squatted among the stones beside the river. Soon, he said, it would be the rainy season — a months-long stretch of downpours that would send this river cascading over its banks and flood his farm with the water he otherwise assiduously avoids.

Asked where the river originated, he pointed, and his gaze traced its path. It wound deeper into the forest, reaching toward the summit — his tribe’s “place of gold,” now a gaping pit.

“Toguraci,” he said. ●

Rin Hindryati in Indonesia contributed to this story.