The crisis was setting off alarms at the highest levels of Bill Clinton’s White House. If the administration got this wrong, it could lose hundreds of millions of taxpayer dollars and spark a backlash against one of the president’s hard-won achievements, the North American Free Trade Agreement.

The Justice Department even warned that failure “could severely undermine our system of justice.”

All of this over a small-time spat in Mississippi between funeral home companies.

It was not the sort of thing that ordinarily catches the attention of top officials in the federal government, let alone causes them to panic. But one of the companies was based in Canada, and it had taken a groundbreaking step: It had filed the very first case against the US under a little-known provision of NAFTA that empowers foreign businesses to sue entire nations before a panel of private arbitrators, usually elite corporate attorneys. Designed to protect international companies when rogue governments seized their assets or flagrantly discriminated against them, this worldwide private justice system has morphed into a tool companies can use to force nations to fork over hundreds of millions or even billions of dollars for enforcing ordinary laws or regulations.

Since NAFTA took effect in 1994, that obscure legal channel, known as investor-state dispute settlement, or ISDS, has widened into a torrent of legal claims, many of them against countries that are poor or facing economic crises. The judgments of this global super court carry enormous power — in the US, they often carry the same authority as Supreme Court rulings — and there is no serious right to appeal.

ISDS has a towering champion, a backer with immense economic and diplomatic muscle: the United States of America.

This week, an 18-month BuzzFeed News investigation has for the first time revealed the system’s true reach and the dangers it poses: how businesses have used ISDS to intimidate nations into gutting their own laws and to get executives off the hook for crimes they’ve been convicted of committing, while some financial firms have found ways to transform this global legal system into a cash cow. Meanwhile, a backlash has turned political figures on the right and left against ISDS, and some countries are rejecting the trade and investment treaties that give ISDS its authority.

But ISDS has a towering champion, a backer with immense economic and diplomatic muscle: the United States of America. Indeed, President Barack Obama is asking Congress to usher in an enormous expansion of ISDS by ratifying a sprawling new trade deal, the Trans-Pacific Partnership, or TPP.

While trumpeting the virtues of ISDS to other countries, the US has only rarely bound itself to treaties with rich countries, the kind that have large corporations likely to launch major ISDS suits. The Trans-Pacific Partnership would radically change that, leaving the US vulnerable to claims from major companies of developed nations such as Japan and Australia.

Responding to fears that signing new trade deals would expose the United States to a deluge of costly ISDS claims, the agency leading the negotiations, the Office of the US Trade Representative, points out that the country has never lost a case. “We have a 100% success rate defending cases against the United States,” the trade representative said in a statement to BuzzFeed News.

That is true. But the untold story of the US government’s frenetic response to the Mississippi dispute belies this public bravado and shows that this unblemished record is largely a function of luck.

The facts of the Mississippi case read like a farce — complete with a bombastic plaintiff's attorney who called himself the “Giant Killer” and traveled in a private jet he named Wings of Justice.

The facts of the Mississippi case read like a farce — complete with a bombastic plaintiff's attorney who called himself the “Giant Killer” and traveled in a private jet he named Wings of Justice.

But there was nothing remotely humorous about the demand for $725 million that the US suddenly faced.

As government lawyers traded anxious memos, groping for some way to make the case go away, the Justice Department offered a blunt assessment of ISDS — one that flatly contradicts what the trade representative has told the American public.

“NAFTA does not simply protect foreign investors from discrimination,” the department concluded. “It provides foreign investors and foreign companies with more rights than Americans have and arguably gives foreign companies an advantage over domestic companies.”

Since the Mississippi funeral home case ended in 2004, the stakes have only grown. The US is staring at a new ISDS suit demanding more than $15 billion. If the US loses major cases — which ISDS lawyers told BuzzFeed News is only a matter of time — then it could find itself grappling with the same grim choice other nations hit with massive ISDS judgments have faced: pay out tens of billions of dollars to private companies or roll back democratically enacted laws.

“I think the US fooled itself into thinking that it wouldn’t be sued because its laws were so investor-friendly,” said José Alvarez, a former State Department lawyer. “The US didn’t anticipate just how creative investment lawyers can be.”

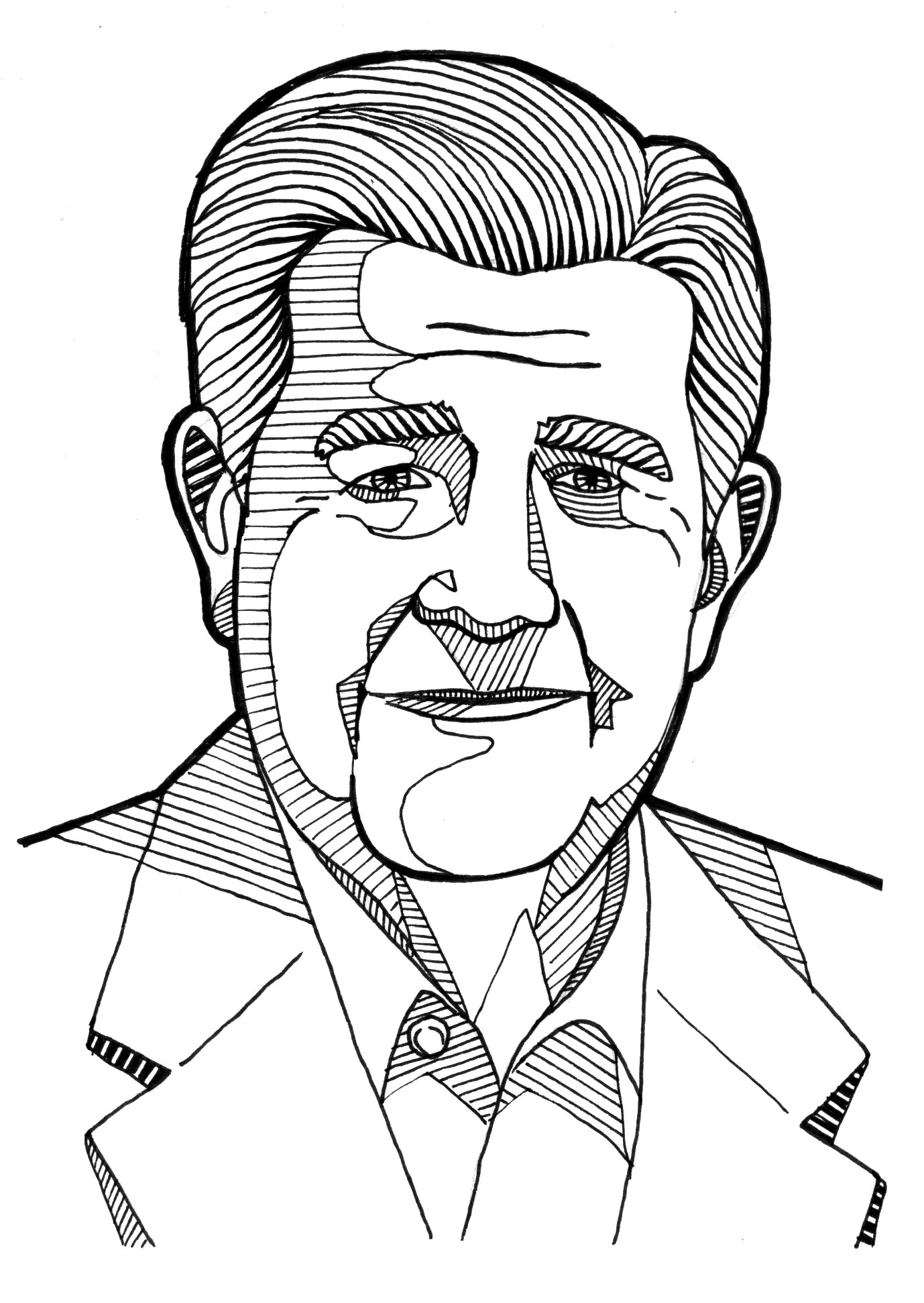

The lawyer Willie Gary had flair — even his enemies would give him that that. He loved to tout his rise from a childhood in poor, Southern farm communities to Ebony magazine’s list of “100 Most Influential Black Americans.” He represented the underdogs, taking down corporate titans with the rhetorical flourishes of a revivalist preacher and winning eye-popping financial judgments. A philanthropist and motivational speaker, he flaunted his Florida mansion, collection of luxury cars, and custom-designed Boeing 737.

He brought that showmanship to bear in the case of O’Keefe v. Loewen, which he turned into a grand battle over race, income inequality, and American values. The actual substance of the case, however, was rather mundane.

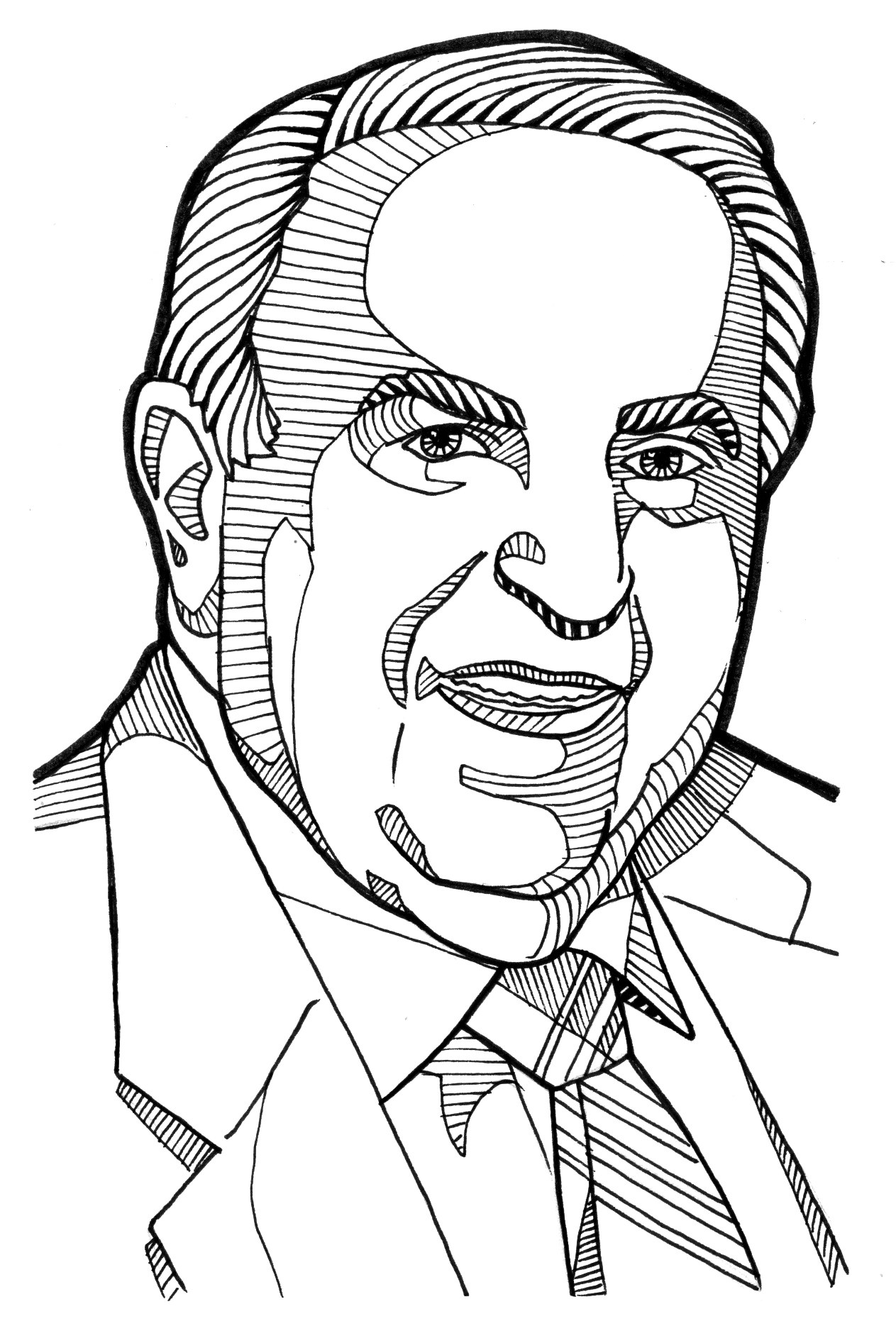

The Loewen Group, a funeral home and cemetery company led by the British Columbia mogul Raymond Loewen, was expanding rapidly into the US. Loewen and a Mississippi businessman named Jerry O’Keefe got in a dustup, largely over the right to sell insurance through a local funeral home. O’Keefe sued Loewen, alleging breach of contract and accusing the Canadian company of trying to mount an illegal takeover of the market. He initially demanded $5 million.

But Gary said he saw more than a simple fight over a contract, something far more sinister: a predatory business model that had to be stopped. “Legally, I tried to crush” Loewen, Gary told BuzzFeed News.

In the Mississippi courtroom, Gary framed the fight in Manichaean terms: Loewen was a rich, white Canadian who came to the state to prey on a local American businessman — O’Keefe — who served black Americans at their moment of deepest grief. O’Keefe was white, but in front of the jury — 8 of whose 12 members were black — Gary painted him as a steadfast friend of the black community, bringing in local black politicians to proclaim that he didn’t have a racist bone in his body.

The invocations of race and class were so frequent that the judge, who was also black, said he’d heard enough about Loewen’s yacht and noted that “the race card has been played.”

So had the nationality card. O’Keefe, Gary intoned, was an “American hero” standing up for his community against a foreign interloper. Gary’s references to Loewen’s foreign citizenship were unending.

Gary even invoked Pearl Harbor. On the day that will live in infamy, “a little voice” had told O’Keefe to fight, Gary told jurors, and he’d volunteered to serve his country the next day. Likewise, when Loewen had “lied to him,” “cheated him,” and “jacked him around,” Gary said, that same “little voice said fight on.”

“You see, that little voice, members of the jury, has a name, and it’s called faith, faith in God,” Gary proclaimed. “It’s called pride, pride in America.”

The jury came back with an award for $260 million.

“I think it was a fair trial,” Gary told BuzzFeed News. He denied stoking anti-foreigner bias and said race became an issue during the trial only after Loewen’s lawyers brought it up. The jurors, he added, “knew that the Loewen Group were bad people. They really were.”

Attempts to reach Loewen through various intermediaries were not successful. O’Keefe, who died recently, was hospitalized when BuzzFeed News called for comment. But his son, Jeffrey O’Keefe, said his father had won the case fair and square.

But there were clear problems with how the jury had awarded such outsize damages. In their haste to penalize Loewen, the jurors had gone rogue — and while the judge reined them in a bit, they weren’t finished. After they piled on punitive damages, the total award was half a billion dollars. It was the largest in Mississippi history, and it made national news.

After the trial, the jury foreman said Loewen “was a rich, dumb Canadian politician who thought he could come down and pull the wool over the eyes of a good ole Mississippi boy. It didn't work.”

That’s pretty much a textbook example of the kind of anti-foreign bias ISDS is supposed to rectify. While the American judicial system may not be entirely immune to such bias, the trade representative has insisted that the US offers a whole battery of safeguards that would kick in long before a company would reach for its last resort: ISDS.

One of the critical safeguards is the right to appeal to a higher court within the United States — and that’s what Loewen tried to do. But under Mississippi law, to appeal he first would have to post a bond for 125% of the award. Loewen didn’t have $625 million sitting around. And though the courts have the option to reduce a bond that “would effectively bankrupt” the company, in this case the state’s supreme court refused.

With the verdict set to take effect in just a few days, and with no good options to pursue, the company’s executives swallowed hard and chose to settle with O’Keefe. Loewen agreed to pay a staggering $175 million.

ISDS traces its roots to the 1950s when Western nations worried that their newly independent colonies would start seizing factories, mines, and oil fields. Some Western leaders also wanted to help these and other economically struggling countries attract major investment. The solution: a neutral, fair system of binding arbitration to settle disputes between countries and the companies doing business within their borders.

But despite proselytizing by the World Bank and some Western European governments, many nations resisted signing up. In the 1980s, as US businesses began to pour more money into projects abroad, many demanded greater protection, and they found a receptive audience in the administration of Ronald Reagan. The US began developing model treaties and convincing a few countries — mostly poorer nations in Africa and Latin America — to sign on.

Then the 1990s arrived. The Soviet Union collapsed, and the economic policies of the US — including ISDS — swept much of the world. Under initiatives backed by the World Bank and the American Bar Association, lawyers fanned out around the world and advised developing countries to sign treaties so they could attract foreign investment. The United Nations’ trade and development body sponsored events where officials from a host of countries went through a round-robin of negotiations and returned home with newly minted treaties.

The number of treaties exploded, swelling in the 1990s alone from fewer than 400 to more than 1,800, laying the foundation for the current boom in ISDS cases.

When the cases started to land, the system took on a distinctly American flair. The 1994 implementation of NAFTA was a watershed. Though the treaty continues to anger those who believe it gutted American manufacturing, NAFTA’s role in the growth of ISDS is a less known but immensely consequential legacy. After the treaty took effect, lawyers began devising ever more creative ISDS claims. Major US law firms saw a lucrative new market for their services. Corporate litigators who had cut their teeth in high-stakes court battles over energy and infrastructure projects flocked to a field where the stakes often were even higher, bringing their bare-knuckle tactics with them.

The people who negotiated the early treaties in the 1980s, wrote Alvarez, the former State Department lawyer, “would never have predicted that the United States would find itself” sued and on “the receiving end of our insistence that the world adhere to our ‘civilized’ standards of treatment.”

But just this year, TransCanada filed a $15 billion ISDS claim against the US, arguing that the Obama administration’s rejection of the company’s controversial Keystone XL pipeline was unfair and discriminatory. The massive project would have a “minimal environmental impact,” a company spokesperson said, and the denial actually was motivated by politics.

In January, another Canadian company accused the United States of violating NAFTA and threatened to hit the US with a separate ISDS suit. Northern Dynasty Minerals had proposed digging out gold and copper from the Pebble Mine, which sparked fierce opposition because it’s located in one of Alaska’s biggest salmon-spawning grounds. After the Environmental Protection Agency said it planned to veto the project, the company’s DC-based lawyer dispatched a letter to the State Department warning, “Since the NAFTA’s entry into force over 21 years ago, the United States — in contrast to its Mexican and Canadian partners — has never lost” an ISDS claim. “I am writing with regard to a case that we believe would change that result, should it go to arbitration.”

In a statement to BuzzFeed News, a Northern Dynasty spokesperson said the EPA’s attempt to block the mine before the company even got to apply for permits was “premature” and “unprecedented.”

These companies don’t allege that they built a pipeline or excavated a mine, only to see it stolen by the US government — the kind of outright expropriation that ISDS was originally set up to check. Instead, these suits strike at US environmental policies, which these companies say have been applied in ways that unfairly harm their businesses.

Around the world, countries facing huge ISDS judgments — topping $1 billion in the biggest cases — have gutted their own laws rather than pay the massive sums and risk still more costly judgments from more companies affected by the laws. In the US, a coalition of activist groups and unions have warned that companies could use ISDS to eviscerate not only environmental regulations but also labor laws. Politicians such as Elizabeth Warren have said the system could endanger financial regulations enacted after the 2008 crisis. And New York Attorney General Eric Schneiderman cautioned that ISDS could curtail his office’s efforts to combat predatory lending and consumer fraud.

The Nobel laureate economist Joseph Stiglitz, Harvard Law School’s Laurence Tribe, and other leading scholars last year urged members of Congress to keep ISDS out of the Trans-Pacific Partnership. Their stark warning: ISDS “risks undermining democratic norms because laws and regulations enacted by democratically-elected officials are put at risk.”

Abner Mikva was a big supporter of NAFTA, including when he served as White House counsel to Bill Clinton shortly after the trade deal took effect.

Nonetheless, he said in an interview before he died this summer, he was surprised when Justice Department officials approached him with a request. A Canadian company had invoked an obscure chapter of that treaty to file an ISDS claim against the US. The way it worked, the company picked one arbitrator, the US another, and both sides would agree on the third. The US government wanted to know: Would Mikva be their guy?

His first reaction, he told BuzzFeed News: “I did not know that there was an arbitration clause” in the treaty. Still, he accepted.

When Loewen and his funeral home company filed their ISDS claim in 1998, it marked the first time the US had been sued under the system it had so avidly promoted. The court proceedings in Mississippi, Loewen alleged, were blatant violations of NAFTA’s guarantees against anti-foreign discrimination and grossly unfair treatment. The sham trial, excessive damages, and requirement that he pay the staggering sum of $625 million merely for the right to appeal had, he argued, coerced him into paying the $175 million settlement and severely damaged his business and his reputation. For compensation, he demanded $725 million.

Soon, top officials in the Justice Department, State Department, and Office of the US Trade Representative were on red alert.

In meetings, government officials scribbled notes that reveal how rude an awakening the Loewen claim was:

“No one thought about this when NAFTA implementing law passed.”

“Floodgates, giving up sovereignty.”

“How much $, who pays, how big a blow up.”

As the February 2000 deadline loomed for the US to file a response to Loewen’s complaint, a memo marked “urgent” landed on the desk of Clinton’s chief of staff, John Podesta, who now runs Hillary Clinton’s presidential campaign. (The campaign declined to make him available for an interview.) Written by some of the president’s top advisers, the memo outlined a crucial strategic decision that the White House needed to make, one that could “affect the long-term viability of the NAFTA itself.”

The different federal agencies all agreed that the US had its back to the wall. The Mississippi court proceedings were widely viewed “as a miscarriage of justice,” the urgent memo said, so, if the ISDS arbitrators got to weigh the actual merits of the case, the US was very likely to lose. The government had to figure out a way to get the case tossed.

But the agencies couldn’t agree on how to do that.

The Justice Department wanted to make the strongest possible argument: that ISDS arbitrators had no authority to sit in judgment of US court decisions.

“Allowing foreign investors to attack the decisions of our domestic courts through international arbitration could severely undermine our system of justice and, as a result, threaten continued public and political support for the NAFTA and, perhaps, other international agreements as well,” a top Justice Department official wrote in one memo. “This could result in a flood of arbitrations against the United States, the cost of which could be extraordinary.”

But the trade representative and the State Department weren’t on board. They feared that argument would leave American businesses operating in Mexico or Canada exposed, unable to seek protection if they got railroaded in those nations' courts.

The memo recommended a compromise, which the government ultimately adopted and presented to the tribunal. ISDS arbitrators could review certain US court decisions, the government argued, but not ones that were strictly between two private companies, such as Loewen’s Mississippi case.

It didn’t work. The arbitrators rejected the argument and let the case continue. A hearing took place in October 2001, and then the tribunal needed to make its decision.

Mikva, the US-appointed arbitrator, recalled that he agonized over his vote. It was impossible, he said, not to think about the political fallout that could follow if he sided with Loewen. He worried that if the US were held “liable for this huge amount of money under a very minor dispute, that the opposition to NAFTA — which was already there — would just have another big talking point for getting rid of it.”

But, he said, “my home-court prejudice was being very, very sorely tested.” He and the other two arbitrators “were just aghast at what had gone on in that Mississippi court,” he said. “The facts were so egregious, so outrageous.”

Then the US got lucky: The Loewen Group filed for bankruptcy and emerged in a new form — as an American company.

The US immediately asked arbitrators to throw out the case, arguing that NAFTA no longer applied, because American companies can’t pursue ISDS claims against the US. Only foreign companies can.

Loewen countered that it needed to be Canadian only when it filed the claim, not all the way through the years-long proceedings. What’s more, the company argued, it was the financial damage from the Mississippi court case that had helped drive it into bankruptcy. It would be perverse, the company argued, to allow the US to take “advantage of its own wrong.”

“By any standard of measurement, the trial involving O’Keefe and Loewen was a disgrace.”

Unmoved, the arbitrators dismissed the company's claim, accepting the new US argument. They also offered another reason they could have thrown out the case: Loewen couldn’t file an ISDS claim because the company hadn’t first exhausted every option available in US courts. It had decided to settle even though it still could have filed an emergency petition with the US Supreme Court, the panel wrote.

The arbitrators acknowledged that, given the circumstances at the time, the decision to settle might have been “inevitable.” After all, Willie Gary was just a few days from being allowed to seize the company’s assets, and petitioning the Supreme Court would almost certainly have failed and wasted precious time. Nonetheless, the panel wrote, the company should have explained to the ISDS tribunal why it didn’t go this route. (In fact, a company director and a lawyer had testified on exactly that point.)

But then the arbitrators did something extraordinary. They offered a sort of postscript seeking to justify their decision to punt the case.

“By any standard of measurement, the trial involving O’Keefe and Loewen was a disgrace,” they wrote. Yet there were larger considerations — considerations that had little to do with the case at hand and everything to do with the politics of intervening in a US court case. The arbitrators had to think about “both the integrity of the domestic judicial system and the viability of NAFTA itself,” they wrote. “The natural instinct, when someone observes a miscarriage of justice, is to step in and try to put it right.” In this instance, however, “the interests of the international investing community” required the arbitrators to “stay our hands.”

In a recent interview, Mikva was more blunt: If not for the fortuitous bankruptcy, the US “absolutely” would have lost.

The Loewen decision sparked condemnation within the small circle of ISDS lawyers and arbitrators. The moderator of a private email list where members of this elite club air their views conducted a poll on the decision. Of the 31 people who weighed in, 28 of them thought the arbitrators got it wrong. America not only got lucky, but it also benefited from something that may not last: deference to the United States — even an outright bias in favor of the US and the trade and investment treaties it has helped promote around the world.

As of today, the US has successfully fought off more than a dozen cases and lost none. “We have been successful,” the US trade representative said in a statement to BuzzFeed News, “because the United States welcomes foreign investment and acts in accordance with our obligations under U.S. and international law, and because our investment agreements contain important substantive and procedural safeguards.”

It also said that the US "has been at the forefront of upgrading, improving, and reforming international investment agreements.” It cited provisions in recent treaties meant to curb overly broad interpretations by arbitrators, increase the system’s transparency, shield public-interest regulations from ISDS challenges, and weed out frivolous claims.

For some ISDS lawyers, a US loss would be the ultimate trophy, a way to become the real giant killer.

The Trans-Pacific Partnership contains further safeguards, the trade representative said. But critics and some experts who have analyzed the deal say the changes amount to little more than tweaks at the margins, leaving intact the most troubling parts of a flawed system — and rendering the United States vulnerable.

Some nations, such as South Africa and Indonesia, have gone much further, drastically reining in ISDS or even purging it from their treaties altogether. The Obama administration is currently pushing to conclude a massive trade deal with EU nations, but the European Commission has proposed turning ISDS into a court system with a roster of judges and an actual appeals body. Asked directly if the the US would support that approach, the trade representative did not answer, saying only, “The EU has proposed one approach to this issue, and we have our own approach.”

Among the ISDS lawyers and arbitrators sometimes known as “The Club,” there seems to be little debate: The question is not if the US will lose, but when. “It’s almost inevitable,” longtime arbitrator Charles Brower said.

For some ISDS lawyers, a US loss would be the ultimate trophy, a way to become the real giant killer. At a panel discussion last year at Georgetown University, State Department attorney David Bigge recounted a conversation he’d had with an ISDS lawyer about a recently filed case against the US: “He said, ‘I wish I had brought that one. The US is going to lose one, and this is going to be it. I wanted to be the one to do it.’” ●