Jeremy Vine pursued by HMRC for disputed tax bills at BBC

Jeremy Vine is being pursued by HMRC for alleged disputed tax bills incurred while working for the BBC, the Telegraph can reveal.

Court documents show that the Radio 2 DJ and broadcaster has been locked in a dispute with the taxman since 2018 over whether he should have been classed as an employee or contractor for his work on the TV series Eggheads and Points of View, as well as coverage of the 2015 general election, between 2013 and 2015.

The amount Mr Vine is being pursued for has not been disclosed but experts have said it is likely to run into the thousands of pounds.

Mr Vine and his defence team had attempted to throw out HM Revenue & Customs’ right to pursue the case with a technical argument at a preliminary hearing which took place in June, but the argument was rejected by a judge. It is now likely the case will progress to the First-tier Tribunal.

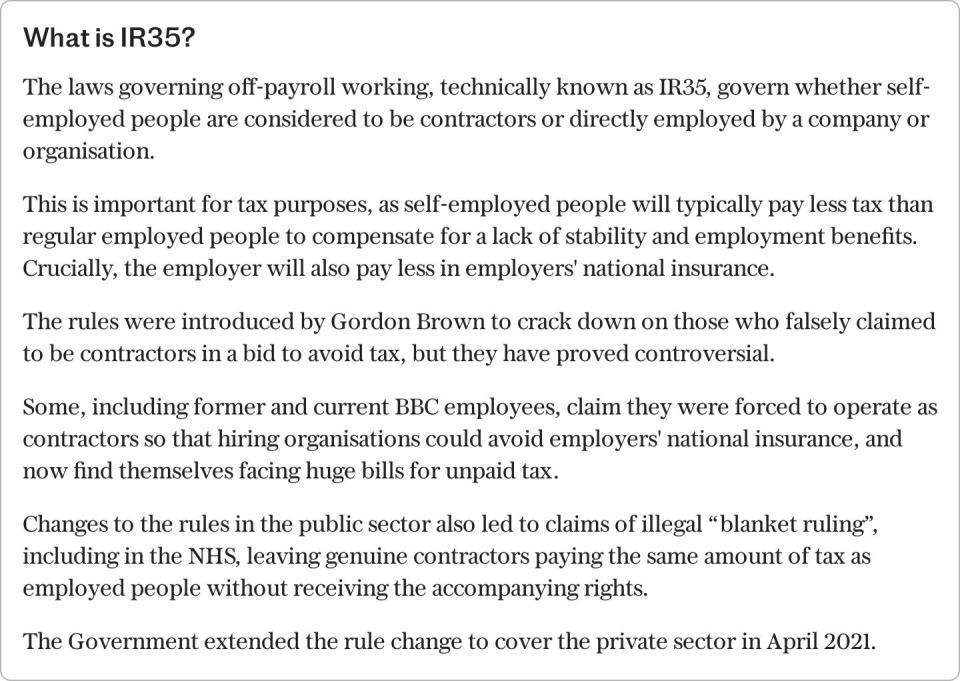

He is the latest celebrity to be chased by HMRC over disputed back taxes relating to off-payroll tax legislation, known as “IR35”.

Broadcasters including Gary Lineker, Adrian Chiles and Kaye Adams have also been embroiled in IR35 cases. Mr Lineker won his £5m tax case in March, while Mr Chiles’ £1.7m case is still ongoing after 10 years. Despite a judge ruling in his favour in 2022, his case is due to be heard again because of “errors in law” made in a prior ruling, it was reported last month. Ms Adams won her case last year after a near decade-long fight with the tax authority. She was represented by the same barrister that is defending Mr Vine.

The rules mean that a worker using an intermediary, such as a limited company, must have their employment status assessed for tax purposes. If they are deemed to be contractors, they pay tax as a self-employed person – meaning they are typically able to pay less National Insurance. But if they are considered to be directly employed by the company using their services, they must pay tax as an employee, usually at higher rates.

The rules were introduced by Gordon Brown to crack down on so-called disguised employees, continuously working at companies as a contractor in order to reduce their tax bills.

The regime is complex and has been criticised for putting companies – notably banks – off of hiring freelancers altogether and hurting the self-employed sector. Kwasi Kwarteng vowed to scrap the rules during his brief time as chancellor under Liz Truss.

John Hood, of accountancy firm Moore Kingston Smith, said: “IR35 has become notorious for trapping celebrities in its complexities. Even tax professionals struggle to understand how it is supposed to work.”

Previous cases have progressed from the First-tier Tribunal to the Upper Tribunal and then to the Court of Appeal, dragging on for several years.

An HMRC spokesman said: “We appreciate there’s a real person behind every case and are committed to treating all taxpayers with respect.

“We seek to resolve cases as quickly and cost-effectively as possible, in accordance with the law.”

Mr Vine was approached for comment.

Yahoo Finance

Yahoo Finance