- News

- City News

- gurgaon News

- NCR housing rates up 49% in 5 years, unsold inventory drops 50%

Trending

NCR housing rates up 49% in 5 years, unsold inventory drops 50%

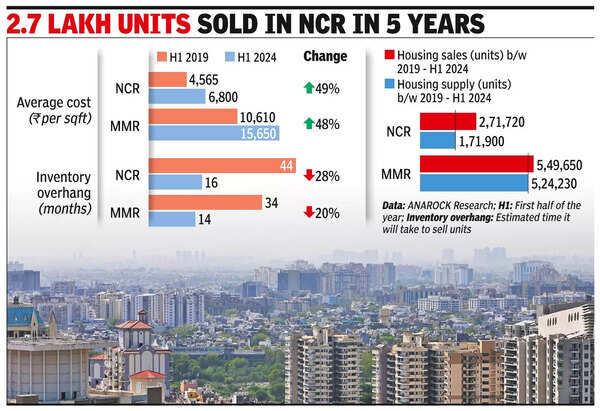

NCR residential prices surged 49% in five years due to rising costs and demand, per Anarock. Unsold inventory dropped significantly. Infrastructure development and larger house demand highlighted. Mohit Kalia noted economic recovery. Aakash Ohri from DLF Home Developers cited robust demand and new projects reflecting a dynamic market.

The report also noted that despite the challenges posed by the pandemic, demand for residential properties in NCR remained high.Developers initially attracted buyers with various offers and incentives, but as demand continued to grow, they gradually increased average prices.

This surge in sales has resulted in a significant reduction in unsold inventory, which decreased by 52% from around 182,000 units at the end of H1 2019 to 86,900 units by the end of H1 2024. Additionally, the inventory overhang has shortened to 16 months in H1 2024, compared to 44 months in H1 2019. “Developers have launched around 172,000 units in NCR between H1 2019 and H1 2024, and 272,000 units were sold during this period,” the report stated.

Mohit Kalia, head (sales), Raheja Developers, said, “The reduction in unsold inventory and the increased absorption rate are positive signs for the market’s continued growth. This surge is not just a testament to the region’s real estate potential but also reflects the broader economic recovery and GDP growth post-pandemic.” Rising residential prices in NCR reflected the increasing demand and rapid development in the region, Rajdarbar Group director Vasudev Garg said, adding that “despite the higher costs, sales continue to surge, driven by a combination of improved infrastructure, robust economic growth, and a desire for modern living spaces”.

The report highlighted that the NCR housing market began to see a revival just before the pandemic, following a period of price stagnation from late 2016 to 2019. Covid-19 too boosted demand for larger houses, pushing sales.

Aakash Ohri, joint managing director of DLF Home Developers, said, “The report indicates robust demand and dynamic growth, especially in prime real estate properties. The interest spans across demographics, attracting both first- and second-generation buyers in pursuit of an elevated lifestyle”.

“Since the pandemic, there has been a surge in latent demand, leading to an outbreak of new project launches. Nearly 3,000 units collectively, were sold out in the pre-launch phase within days,” he added.

End of Article

FOLLOW US ON SOCIAL MEDIA