5 tips that will make tax season less stressful, according to pros

Minimize the chaos with these ways to get organized

Credit:

The Container Store

Credit:

The Container Store

Products are chosen independently by our editors. Purchases made through our links may earn us a commission.

At this time of year, many people like bringing up the old aphorism that nothing in life can ever be certain, save for death and taxes.

No offense to Benjamin Franklin, to whom this quote is often attributed, but we think this idiom is missing one important inevitability: paperwork. (Which, to be fair, is a component of both.) The complexity associated with completing your taxes may vary from year to year, but a need to reference a variety of documents—whether they’re W-2s, 1099s, receipts, or all of the above—never does.

In essence, paperwork around tax season is different for everyone, but everyone has paperwork. Here’s how you should save it, back it up, and keep it straight, according to a professional organizer and a CPA.

Create a checklist of everything you need

Making a checklist of all the documents you need can be helpful.

Not sure exactly what papers matter? That depends on you, your job, and the year you’ve had, but the “bare minimum” most people need, according to Amy Northard, a CPA and owner of The Accountants For Creatives, are things like 1099s, W-2s, 1098s, student loan interest forms, and health insurance 1095 forms. “The two things I see forgotten generally don't get mailed out and have to be downloaded,” Northard says. “They are student loan interest forms and investment or brokerage account 1099 statements.”

If you have to gather your forms from different places, Lindsay O’Brien, a professional organizer and owner of Room to Breathe NYC recommends writing down a checklist as a point of reference. Then, once you’ve found them all, consolidate them into a physical or digital location. This way, “you end up with one one tax folder (either physical or digital) with all necessary documents,” says O’Brien.

Use technology to your advantage

An external hard drive is key for saving your documents.

You may find it most convenient to keep your documents digitally. This helps you avoid paper clutter in your home and makes it easy to access everything you need for your taxes all at once. “Most paperwork can be found online if we really need it,” says O’Brien. “If you are receiving bills in the mail, I recommend going paperless and having them emailed or set up automatic payments. Same thing with receipts—have them emailed or texted rather than printed.”

Round up the digital documents you have, rename each with the year and purpose to make them easy to sort through later, and save them in secure password-protected folders on your computer, which you can do on both iOS and Windows. Then, back up your computer files with an external, encryptable hard drive, like the Western Digital portable hard drive, or a cloud-based file-storage service like Dropbox. If you go for the cloud, be sure your service uses two-factor verification (Dropbox as well as Apple iCloud and Google Drive have it as an option you must turn on), so your files are more secure.

Also, don’t delete the files once you’ve completed your taxes—when you tackle them next year, checking out older documents can be helpful to guide you through the same process. “When it's time to start working on taxes, take a look at your tax return from the prior year to refresh yourself on what you reported previously and hunt down any forms you may not have received in the mail,” Northard says.

Digitize paper with an app or a scanner

A scanner helps digitize all your documents.

Of course, there will be some paperwork that presents in your life as actual paper. It’s not as difficult to digitize these items as you might think. O’Brien recommends the smartphone app Genius Scan that allows you to take a photo of a document and convert it to PDF. “I especially recommend this for tax-related documents so that you can easily send the files to your accountant or easily upload to TurboTax or other tax platform that you use to file,” she says. The free version of Genius Scan has a solid privacy policy—documents are only saved automatically to your phone, not anywhere else—but for more “sensitive” documents, one of its upgraded versions, like Genius Scan Enterprise, makes it easier to restrict outside access to the files.

If you have a lot more paperwork or prefer the more efficient method of a full-size scanner, we tested and loved the Epson Workforce Pro, which provides speedy, accurate scanning—as well as printing—in one compact package.

Use a file bin to ensure documents are in one spot

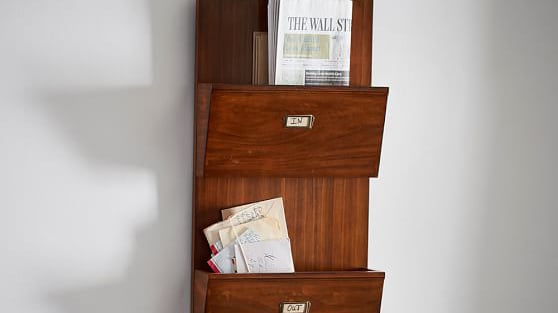

Keeping a letter file bin near your front door can help you sort mail as soon as you get it.

Even if you’re all about digitization, don’t toss all your paper documents right away. Instead, put them in a clearly-labeled file bin in a spot you know can see and access with ease so you can organize things without losing them. “Sorting your papers throughout the year can make tax season a lot less stressful. I always recommend clients have some sort of mail holder near the front door of their home like the Pottery Barn Office Letter File Bin,” says O’Brien. She recommends sorting your mail as soon as you receive it into categories like “coupons,” “action items, “important,” and “recycle,” and setting a day each week to go through the bin before it gets too full.

Get the Office Letter File Bin from Pottery Barn for $58.99

Make filing a habit

Prompt filing will make your life easier come tax season.

For holding onto historic files, O’Brien recommends organizers such as a filing cabinet for housing historic documents, a filing box for this year’s paperwork, and hanging file folders and labels for making sense of what’s in each. Pro tip from Northard: If you’re dealing with a lot of receipts, start a folder for each month to keep them separate and organized—and make a habit of putting things in their rightful place as soon as you can, not when it's time to file your taxes. This helps make it less likely that you'll lose important documents and receipts and ensure things are there when you need them.

- Get the Poppin 3-Drawer Filing Cabinet from The Container Store for $249.99

- Get the Weathertight File Box from The Container Store for $14.99

- Get Amazon Basics Hanging File Folders on Amazon for $9.99

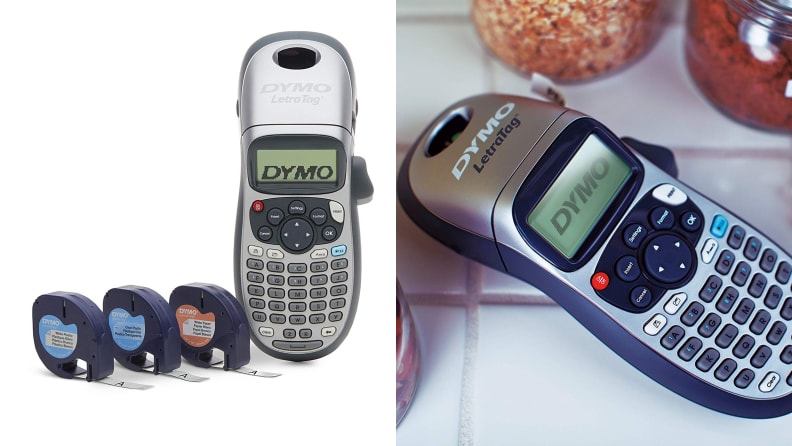

Use a label maker to keep track of all your things

Do you need a label maker? No. But they are nice to have around.

Labeling is key for all organization devices, as it allows you to grab the documents you need without too much rummaging. For said labels, you can write them by hand on blank stickers—or if you’re feeling a little extra (or know you'll need motivation to actually get around to labeling your things) get a label maker. “They aren't necessary, but they sure are fun,” O’Brien says.