Sam Bankman-Fried did not appear to react on Thursday morning when Manhattan federal judge Lewis Kaplan read out his prison sentence. The former crypto billionaire stood there, skinny, his hair wild and curly, wearing an olive jumpsuit, the chains around his legs rattling whenever he would move. For the seven counts of fraud and conspiracy that he was found guilty of last year, he would spend 25 years in prison. In addition to that, he would serve another three years of supervised release and pay back more than $11 billion. It put an end to, for now, one of the largest and most consequential financial frauds in history, “disabling him, to the extent it can be done, for a significant period of time,” in the words of Judge Kaplan.

Even after everything that the public has learned about the duplicitous life of SBF, the decision was met with a heavy silence in the courtroom on the 26th floor of the courthouse in downtown Manhattan. His financial empire blew up about a year and a half ago, exposing that he stole more than $8 billion from the customers on his exchange, FTX, and then secretly funneled that money into his hedge fund, Alameda Research. But the decision was not just about the money. From the bench, Judge Kaplan had made the case that SBF was not some harmless fraudster. The defendant, he noted, had perjured himself at least three times during his time on the stand. He had obstructed justice by trying to tamper with a witness. He was evasive and frustrating even when he appeared to be telling the truth. And, Judge Kaplan noted, there is no telling whether the onetime boy wonder of digital currencies would use any leniency to try to defraud millions of customers again.

“The judgment has to adequately reflect the seriousness of the crime, and the crime was a very serious crime,” Kaplan said.

In the packed courtroom, the hearing centered on the real SBF. He is, as has been noted, a multitudinous figure — capable of immense crimes and great philanthropy. At about 10:43 a.m., the public got to hear from him directly. He stood and, for about 20 minutes, made a halting, rambling speech that focused on getting customers back their money and on the bad decisions he made as the head of his companies. “I made a series of bad decisions. They weren’t selfish decisions. They weren’t selfless decisions. They were bad,” he said. “I’m sorry for that. I’m sorry about what happened at every stage.” On the whole, these statements weren’t very different from the ones he made shortly after the collapse — the ones in which he stopped just short of admitting that he’d done anything criminally wrong. Except for his tone, they didn’t differ much from his disastrous testimony during his fall trial. After he spoke, Assistant U.S. Attorney Nicolas Roos noted that he did not apologize for stealing any money, as did Kaplan. “He knew it was wrong. He knew it was criminal,” Kaplan said. “But he’s not going to admit a thing, as is his right.” (SBF’s attorney said he plans to appeal.)

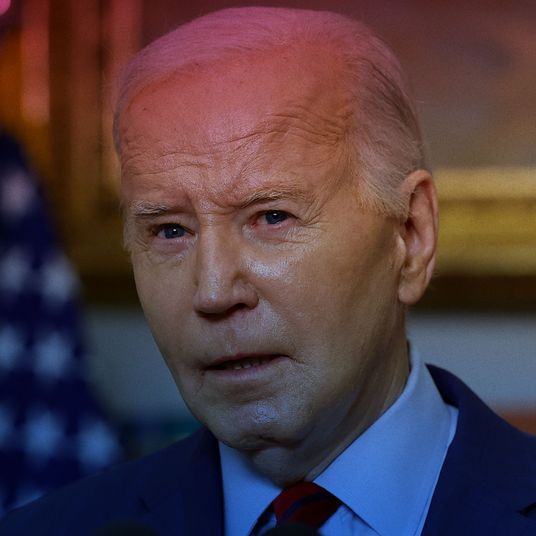

Before there was the sentencing, there was the damage control. Since the verdict, conventional wisdom has increasingly settled on the trial being a slam dunk, but it was a carefully managed argument. Early on, federal prosecutors Danielle Sassoon and Roos would bring up trivialities: He didn’t sleep on a beanbag chair as much as he said he did; he connected the length and wildness of his hair to his net worth. Caroline Ellison, his ex-girlfriend and the former CEO of Alameda Research (who also pleaded guilty to charges and is cooperating with the government), said that his famous penchant for driving a Toyota Corolla was a ruse. The strategy here was to undermine him at his core. At the center of FTX was a sham, they argued, because SBF himself was a sham. When prosecutors this month released notes that Bankman-Fried wrote to himself showing that he, the No. 2 donor to the 2020 Biden campaign, planned to “come out as Republican” on Tucker Carlson’s show, it served as a reminder that this is a guy who will do anything, and say anything, to avoid having to suffer consequences.

It is tough to come back from that, though Bankman-Fried’s lawyers tried. Marc Mukasey, his attorney following the conviction, has attacked the possibility that his client could stay in prison for a century as “grotesque.” SBF’s team has offered three core arguments against an extended sentence: that he is essentially a good person, that the crime was victimless, and that a long sentence should be reserved for bigger dangers to society. “Sam is a 31-year-old non-violent offender … in a matter where victims are poised to recover — were always poised to recover — a hundred cents on the dollar,” Mukasey wrote in a February sentencing memorandum. He went on to argue that an effective life sentence should be reserved for people like Al Qaeda terrorists and the like. The upshot was that SBF should do six years — far shorter than the 40 to 50 years that prosecutors were looking for. His mother, Barbara Fried, wrote a six-page letter that pushed back on his portrayal as a “freak with evil intentions” and argued that because he has autism, the potential for him to misread social cues in prison could endanger him. Other supporters wrote about his philanthropy, his altruistic bent on life since well before he was a famous crypto billionaire.

On Thursday, Mukasey made an extremely skillful argument for a light sentence for his client, comparing him favorably to financial sociopaths like Bernie Madoff. “Sam was not a ruthless financial serial killer who set out every morning to hurt people,” he said. “He doesn’t make decisions with malice in his heart; he makes decisions with math in his head.” It was an argument made most prominently by Michael Lewis, whose book was a kind of apologia for Bankman-Fried’s preternatural ability to make decisions on probability.

But the argument was, perhaps, the one that did him in the most. As Roos noted, SBF made a calculated decision — and if it had worked, he would have done it again. “It’s his nature,” Kaplan said. He quoted from testimony by Ellison, who said that he had sought political power and had even figured there was a small chance that he could be elected president of the United States. “The goal was power and influence,” he said.

Cases like Bankman-Fried’s cut right to the heart of the contradictions in white-collar criminal law. The trials themselves are often deeply complex. Teams of prosecutors have years, often decades, of technical expertise not only in the law but in the ways of financial markets. Then, after securing a conviction, the argument from the defense boils down to, Well, nobody really got hurt. This was, at least, the case with Bankman-Fried, whose lawyers argued that, essentially, this was a victimless crime. There is no body is the problem with financial prosecutions. There were no bloody crime-scene photos for the jury to consider. Nobody in the jury heard about anyone who lost their life or had any serious bodily injury. A gap in time between the conviction and the sentencing — nearly five months in SBF’s case — may not matter in terms of the law, but it certainly can give some distance between a heated trial and the sentencing.

“Bankman-Fried obstructed justice before trial by trying to tamper with witnesses. His bond was revoked. During trial, he took the stand and he lied through his teeth — he perjured himself,” said Neama Rahmani, a former federal prosecutor in California. “This isn’t someone who has accepted any responsibility. This isn’t someone that has put forth any type of mitigation package.”

Federal prosecutors received more than 200 letters from victims called impact statements. These are letters from people around the world — FTX was, in fact, much more important outside the U.S. than it was domestically — and to read through them is to see a world that SBF would have otherwise preferred the court not see. To even read through a handful of these statements is to see but a small example of the scale of the destruction wrought by the collapse of SBF’s fraud.

These statements aren’t signed, and most identifying information has been redacted by the Justice Department, but it’s worth pausing on a single life. Impact Statement No. 114 starts by wanting to express the “profound and devastating impact that the collapse of FTX has had on my life and the lives of my loved ones.” This person had been trading on FTX since July 2021, in part to provide more financial security for his loved ones: “For a long time, I have been the financial backbone for both my own family and my wife’s family. The failure of FTX has not only affected my financial stability but has also caused a ripple effect of suffering and hardship for those I care for deeply.”

Statement No. 114 goes on. Ever since withdrawals were halted, he says he was unable to “pay for my sister’s heart surgery and her ongoing medical expenses, leaving her health and future in jeopardy.” He has struggled to pay college tuition for his brother. Booking fees and down payments on a house and a car were lost after he lost access to the rest of his money. He and his wife have experienced “severe depression” that has nearly ended their marriage. “My wife and I were forced to halt our fertility treatments after 8 years of marriage without a child, dashing our hopes of starting a family.”

This is what’s most devastating about a crime such as this: Money makes modern life possible. What SBF’s fraud did was withdraw the possibilities that were before these people’s real lives. SBF was a massive presence in the world, an economy unto himself, a figure around which billions and billions of dollars’ worth of assets revolved. He allowed millions of people to depend on him by creating an image of stability when he was really stealing their money and using it for his own personal financial gain. And he lied — he lied to his customers, to his investors, to Congress. When he got caught, he kept on lying. When Judge Kaplan was considering a sentence for SBF, it is true that there was no body, no show of physical harm, that could be used in his calculation. For the writer of letter No. 114 and his family, does that make a difference? To them, SBF robbed them of a life.