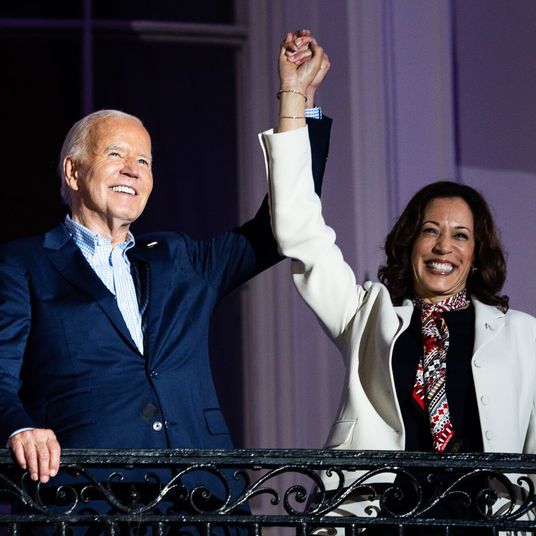

President Joe Biden, despite what he may say to the contrary, is something of an oil guy. Maybe it’s not intentional, since he’s expanding electric-vehicle infrastructure and has pledged to reduce federal emissions by 65 percent by 2030. But last fall, before the war in Ukraine broke out and sent oil markets soaring, he was pushing OPEC+ to pump more oil during the U.N. Climate Change Conference in Glasgow. His push to ban the buying/import of Russian oil, following the war in Ukraine, has pushed up crude prices the world over and effectively diverted the commodities to China and India. He’s allowed drilling on public land, and he is attacking oil companies both for making too much money and not producing enough. On Wednesday, he called on Congress to pass a three-month federal gas-tax holiday, in the model of similar breaks given by New York and other states —a policy that might juice demand by making it more affordable to get on the road.

Maybe you don’t care, you’re kinda broke, and you’re just wondering how much in savings you’re looking at. Well, it’s about 18.4 cents a gallon for regular gas and 24.4 cents for diesel fuel. So your typical driver would save $1.84 for every ten gallons. Is it worth it? These taxes pay for the upkeep of roads in the first place — and crumbling infrastructure passes on significantly higher costs for your average consumer.

The good news is that there is a policy shift under way that will end up lowering the price of gas: the tanking of the economy. The Federal Reserve — which is independent of the White House — is in the midst of a historically steep interest-rate-hike regime in order to tame the worst inflation in generations: It just ratcheted up borrowing costs by 0.75 percent last week, the biggest hike in 28 years. And Biden has given Federal Reserve chairman Jerome Powell the political cover to do what he needs to do to tamp down rising prices, which Biden called his “top economic priority.” (Powell noted on Wednesday that interest-rate hikes probably won’t bring down the price of food or gas, though, so good luck with all that).

Oil traders are betting that the slowdown in the economy — with a possible recession looming on the horizon — will actually have a much bigger effect on the price of gas, since that will depress demand. Here’s Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, in MarketWatch: “A persistent fall in oil prices will hint that the global recession fears are taking the upper hand, and weigh heavier than the positive factors such as a tight supply, prospects of Chinese reopening and booming travel.”

The reality is that gas prices are already starting to fall, even though they’re still higher than normal. Patrick de Haan, an energy analyst at GasBuddy, noted that demand is flattening out and continuing to drop.

Regardless, any federal gas-tax holiday would have to pass Congress, and Senator John Thune, speaking for Republicans, has already called it “dead on arrival.” Maybe that’s because the GOP doesn’t want to hand Biden credit if and when gas prices start to fall back down to earth.