The Biden administration banned new imports of Russian energy Tuesday, closing one of the few remaining loopholes in the West’s sanctions against Vladimir Putin’s rogue state.

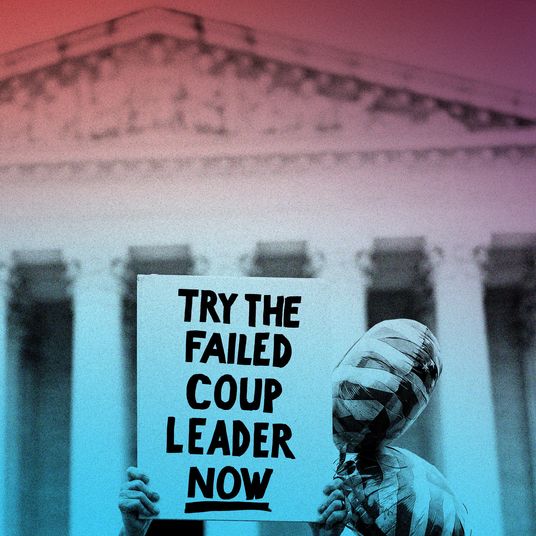

Although the United States and the European Union have forsworn military confrontation with Russia, they have waged something akin to financial war on Putin’s regime. In addition to sanctioning Russia’s oligarchs and seizing their assets, the U.S. and the E.U. have effectively evicted Russia’s entire banking system from the global financial order and blocked Moscow from accessing the sovereign currency reserves it had deposited in western financial institutions.

These moves proved sufficient to tank the ruble’s value and plunge Russia into its worst economic crisis in decades. According to analysts at JPMorgan Chase, the Russian economy is now poised to shrink by 7 percent this year. Other forecasters paint an even darker picture, with the Institute of International Finance projecting a 15 percent contraction of Russia’s GDP.

Still, the sanctions included loopholes large enough to run oil tankers through: With energy prices already elevated in the wake of the COVID-19 crisis, Biden and his European counterparts provided an exemption for Russian oil, gas, and coal exports, which constitute 5 percent of the global energy supply.

But the Kremlin’s increasingly brutal tactics in Ukraine inspired bipartisan congressional support for banning all of Russia’s wares from the U.S. Over the weekend, congressional staffers drafted legislation banning Russian crude imports that was set to receive a House vote Wednesday. This forced Biden’s hand. Unwilling to veto a bipartisan attempt to aid Ukraine, the president chose to preempt the bill by banning Russian energy imports using his executive authority. This approach enables Biden to assume the mantle of leadership on the issue, while also giving his administration the flexibility to relax the ban unilaterally in exchange for Russian concessions.

The ban will doubtlessly increase U.S. energy costs. But America is not especially reliant on Russian energy, and many U.S. traders and refiners had already begun boycotting Russian oil before Biden’s order. Roughly 8 percent of America’s oil and petroleum imports came from Russia in 2021, while Russian crude-oil imports constituted 3 percent of the U.S. total. The Biden administration is exploring the possibility of replacing that missing energy by lifting sanctions on Venezuelan and Iranian oil imports.

For Russia, the true nightmare is losing access not to the U.S. energy market but to the European one. The E.U. imports more crude oil from Russia than it does from any other nation. Altogether, Russian crude accounted for 27 percent of European oil imports as of 2019. Given this dependency, a European ban on Russian energy would be far more significant than the American one. It would impose an enormous burden on E.U. consumers, one that would ripple out to afflict energy users the world over: If Europe suddenly needs to replace more than a quarter of its oil imports, demand for non-Russian energy will skyrocket, leading to bidding wars that push up prices globally.

Thus far, the E.U. is holding out against a full ban. But the European Commission did publish a plan Tuesday for slashing the bloc’s consumption of Russian gas by two-thirds within the year and fully eliminating it before 2030.

In the U.S., the Republican Party sees nothing but upside in Biden’s energy ban. Pushing for the measure enabled the GOP to demonstrate its “toughness” on foreign policy. The economic implications of the measure, meanwhile, will simultaneously increase profits for GOP-aligned fossil-fuel producers and, in all probability, undermine Biden politically. Voters tend to blame the president’s party for rising gas prices. And Republicans are supplying them with a rationale for laying the blame at Biden’s feet: The administration has restricted new drilling on federal lands, thereby suppressing American energy production.

But this narrative is false. In reality, the slowdown in fossil-fuel extraction by U.S. firms is a product of their own shareholders’ risk aversion, not federal climate policy. After suffering years of poor returns, oil and gas investors have forced fossil-fuel companies to prioritize windfall profits over new investment. If this preference were to shift, the Biden administration’s policy would be no obstacle to a drastic expansion in production. As Barron’s reported in November, U.S. companies already own drilling rights on “so much federal acreage that they have enough to drill for years without needing to apply for more permits.”

Regardless, the U.S. ban and complementary measures by the E.U. will further devastate the Russian economy, increasing pressure on Putin to reach a negotiated settlement with the Ukrainians. If Biden’s new sanctions succeed in breaking Moscow’s will, he could see a turn in his political fortunes. Biden has enjoyed an uptick in approval in multiple recent polls, apparently enjoying the benefits of a “rally around the flag” effect. Were Biden’s strategy to succeed in preserving an independent Ukraine — thereby clearing the way for a lifting of sanctions on Russia and consequent decline in gas prices over the second half of this year — November’s midterms could prove less catastrophic for his party. More importantly, such an outcome would stanch Ukraine’s bleeding and preserve its embattled sovereignty. For now, though, all hopeful scenarios are mere hypotheticals. And between today and their potential realization, more pain is a certainty.

More on russia

- Has the Havana Syndrome Mystery Finally Been Solved?

- Alexei Navalny Was Buried to the Terminator 2 Theme Song

- Why This Is the Tensest Nuclear Moment in 60 Years