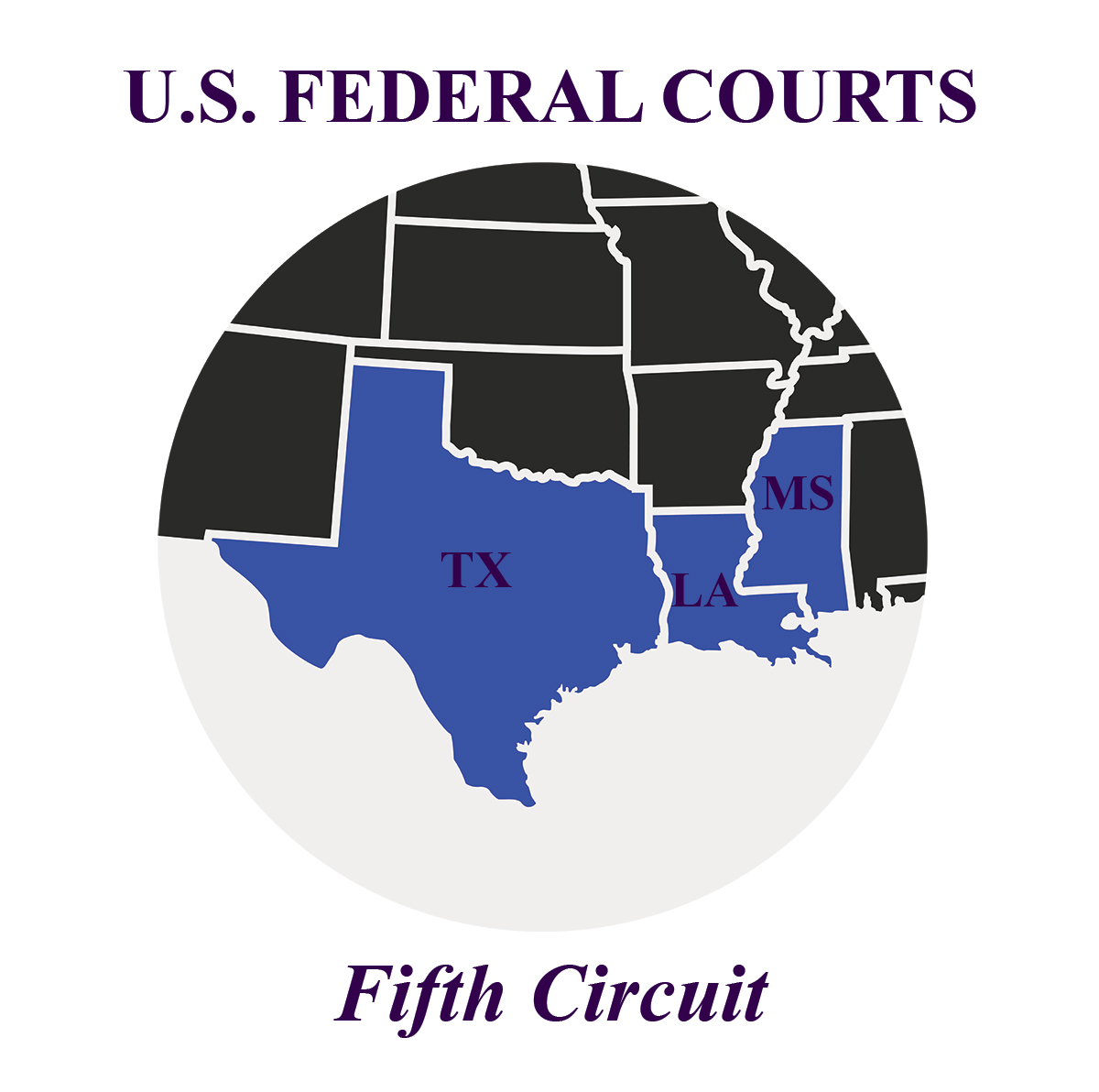

On July 3, 2024, the US District Court of Northern Texas issued a Memorandum Opinion and Order in the combined cases of Americans for Beneficiary Choice, et al. v. United States Department of Health and Human Services (Civ. Action No. 4:24-cv-00439) and Council for Medicare Council, et al., v. United States Department of Health and Human Services (Civ. Action No. 4:24-cv-00446).

The Plaintiffs (in this combined case) challenged the Centers for Medicare and Medicaid Services (“CMS”) rule issued earlier this year. The new rules attempt to place reimbursements to third-party firms into the definition of compensation where the prior rules did not include reimbursements into the definition of compensation which would have been subject to the regulatory cap on compensation.

This Memorandum Opinion Order granted the Plaintiffs’ Motion for a Stay in part and denied it in part. The Motion was granted in relation to the new CMS rules around compensation paid by Medicare Advantage and Part D plans to independent agents and brokers who help beneficiaries select and enroll in private plans.

The Court found that the compensation changes were arbitrary and capricious and that the Plaintiffs were substantially likely to succeed on the merits of the case. The Court found that CMS failed to substantiate key parts of the final rule. During the rulemaking process, industry commenters asked for clarification around parts of the rule, but CMS claimed “the sources Plaintiffs criticized were not significant enough to warrant defending them.” The Court found “because CMS failed to address important problems to their central evidence…that members of the public raised during the comment period, those aspects of the Final Rule are most likely arbitrary and capricious.”

One of the Plaintiffs, Americans for Beneficiary Choice, also challenged the consent requirement of the final rule. The final rule states that personal beneficiary data collected by a third party marketing organization (“TPMO”) can only be shared with another TPMO if the beneficiary gives prior express written consent. The Plaintiff argued that the consent requirement is “in tension with HIPAA’s broader purpose of facilitating data sharing” and CMS stated that HIPAA might facilitate data sharing, but that does not limit CMS’s ability to limit certain harmful data-sharing practices. The Court denied the Motion to Stay regarding the consent requirement, but interestingly stated that Plaintiff’s “claim regarding the Consent Requirement may ultimately have merit, [Plaintiff]’s current briefing does not demonstrate a substantial likelihood of success at this stage”.

What does this mean now that we are less than 90 days from the start of the 2025 Medicare Advantage/Part D contract year?

- The consent requirement is still moving forward – While the memorandum order hints at the possibility of it being rejected, as of right now, TPMO’s must get prior express written consent before sharing personal beneficiary data with another TPMO.

- The fixed-fee and contract-terms restrictions in the final rule have had their effective date’s stayed until this suit is resolved. Therefore, the compensation scheme that was in place last year is essentially the same for those two sections.

How does this affect the FCC’s 1:1 Ruling?

It doesn’t. While this case does show that courts are willing to look critically at agencies’s rulemaking process, the FCC’s 1:1 consent requirement is different than the compensation changes set forth by CMS.

The FCC arguably just clarified the existing rule around prior express written consent by requiring the consent to “authorize no more than one identified seller”.

CMS, on the other hand, attempted to make wholesale changes and “began to set fixed rates for a wide range of administrative payments that were previously uncapped and unregulated as compensation.”

There is still the IMC case against the FCC , so there is the possibility (albeit small) there could be relief coming in that case. However, the advice here is to continue planning for obtaining consent to share personal beneficiary data AND single seller consent.