Celestia’s (TIA) price rise in the last few days made it one of the best-performing assets this week and in the last 24 hours.

But instead of imbuing confidence and optimism, the rally inspired investors to take a different, more bearish path to churn profits.

Celestia Investors Want a Crash

Celestia’s price had a good run this week as the altcoin recovered most of its recent losses. But as this happened, TIA holders got the idea to take a more destructive idea of shorting the altcoin heavily. Signs of the same are visible in the Open Interest and Funding Rate.

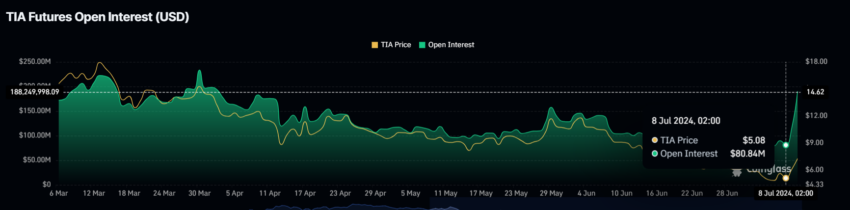

Celestia’s Open Interest has spiked significantly in the last two days, doubling from $80 million to $190 million. This sharp increase indicates a substantial surge in trading activity and investment in the altcoin.

The rapid rise in Open Interest generally highlights growing interest and confidence among traders and investors. But this is not the case with Celestia. TIA traders are pining for a price decline, which can be noted in the direction of the funding rate.

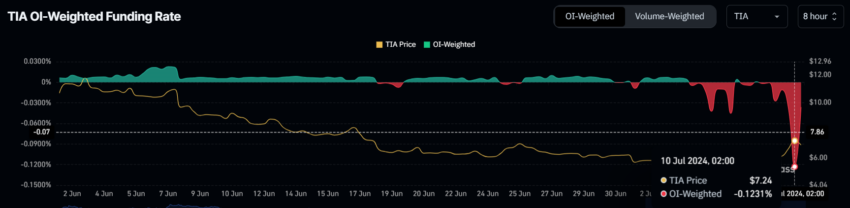

TIA’s Funding rate has turned negative from positive, reaching the highest point since its inception. A negative funding rate typically indicates that short positions are paying long positions, reflecting a bearish sentiment among traders.

Read More: Best Upcoming Airdrops in 2024

Combining the two metrics, it becomes evident that the surge in OI is showcasing the rise in short contracts, bringing the funding rate down to historic lows. This shows that TIA holders are expecting and demanding a price drawdown following the rally.

TIA Price Prediction: Where Could It End Up?

Celestia’s price can take two directions. One is as per the demand of the investors, and the second is the one that the market suggests. IF TIA follows investors’ demand, it could end up losing the recent gains and drop to $4.9.

Trading at $6.6, this could result in a 24% decline, signs of which are already visible in the 8% decline today.

Read More: Top 10 Aspiring Crypto Coins for 2024

On the other hand, if the price jumps back up to breach and flips $7.2 into a support level, a rise beyond $8.1 is likely. This would push Celestia’s price to $10 and invalidate the bearish thesis.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.