BONK’s price could be recovering owing to the bullish actions of investors observed over the last few days.

This could help the meme coin undo the damage done in the past month, which led to a 50% correction.

BONK Investors Appear Bullish

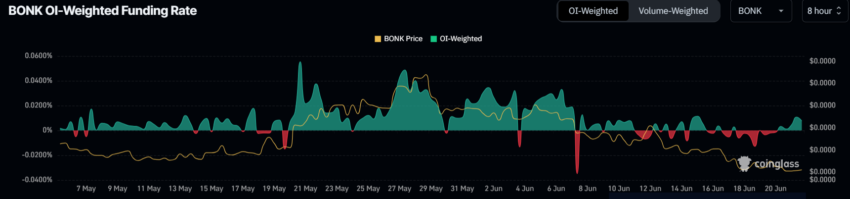

BONK’s price rise sits in the hands of its investors, who are changing their tune now. After more than 11 days, BONK’s funding rates have turned positive from negative. This shift suggests that long contracts are now dominating the market, as opposed to shorts’ domination noted during negative rates.

The positive funding rates imply that traders are willing to pay a premium to maintain their long positions. This indicates increased investor confidence in the altcoin’s upward potential, reflecting a bullish sentiment. This change can be a key driver for BONK’s price in the near term.

Read More: Bonk Airdrop Eligibility: Who Can Claim and How?

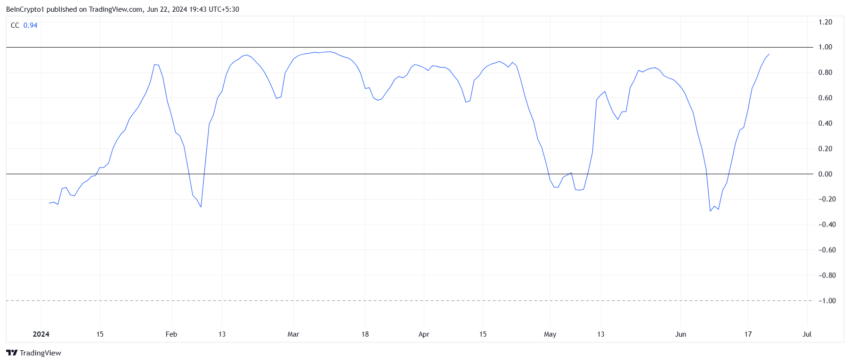

Additionally, BONK’s correlation with Bitcoin (BTC) is currently at a high of 0.94. This strong correlation means that the price movements of meme coins are closely aligned with those of BTC.

Given this high correlation, BONK’s price could benefit significantly from any Bitcoin price recovery. As BTC stabilizes and potentially rises, the meme coin will likely follow suit, potentially leading to gains for its investors.

BONK Price Prediction: Climbing Back From Lows

BONK’s price, trading at $0.00002103, is at a three-month low at the time of writing, just below the support of $0.00002153. The meme coin’s 48% drawdown in almost a month could be reversed if the altcoin climbs back above $0.00002500. The target, however, is higher at $0.00002748 but would warrant BONK holders to continue to act bullish.

Read More: 11 Top Solana Meme Coins to Watch in June 2024

Should this fail from happening, the meme coin could be vulnerable to a decline below $0.00002000, likely falling to $0.00001500. If this support is broken too, the BONK’s price would drop to 0.00001375 and invalidate the bullish thesis.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.